Supply shortage and high demand lead to overbidding on the market and sharp price increases

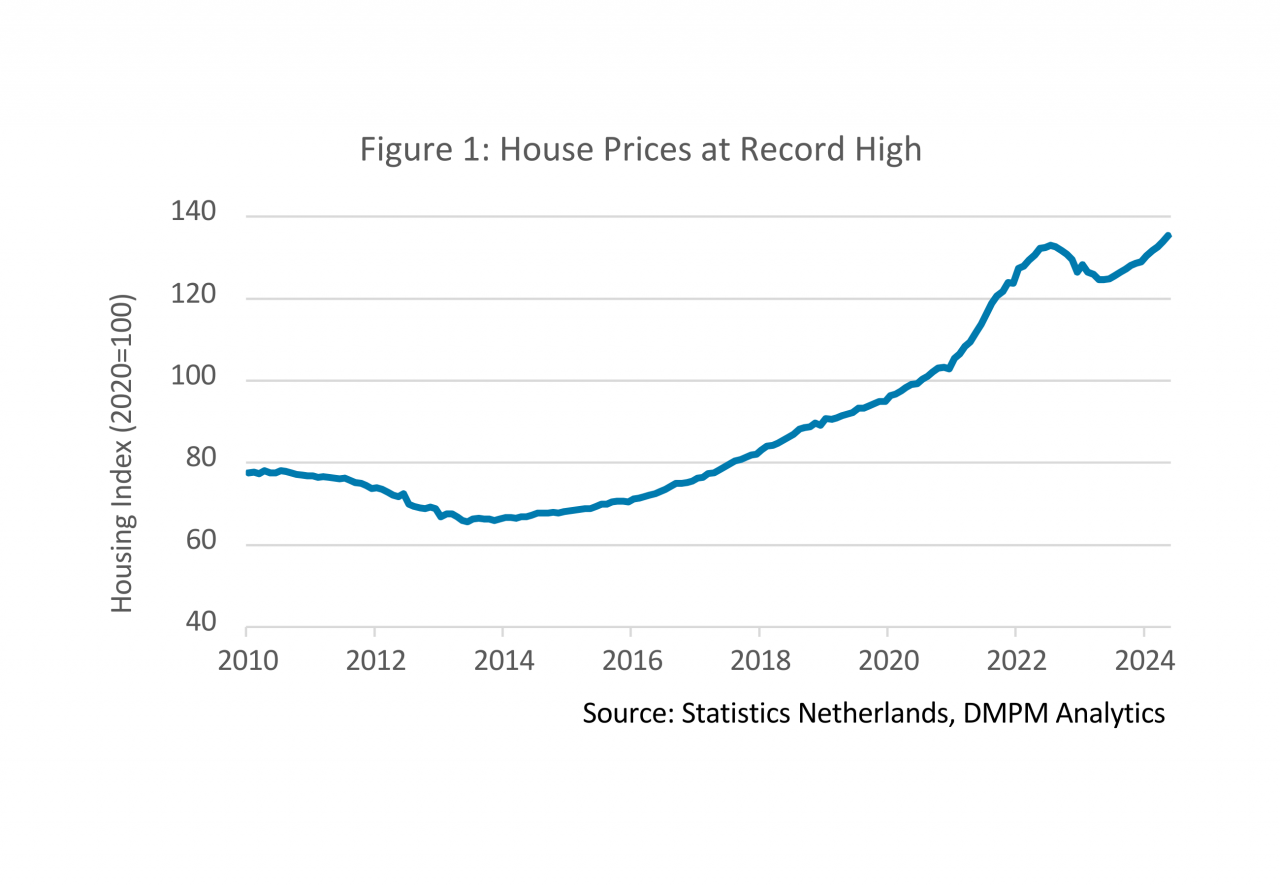

Compared to the second quarter of 2023, prices rose 13.6%. This is the largest QoQ increase in two years. House prices have never been as high as last quarter, reports the Dutch Association of Realtors and Valuers (NVM). The average selling price of existing houses in the second quarter was €468,000.

Door Eric Rood

Portfolio Manager

The Netherlands are not only emerging from a dip in which the number of transactions fell by 20%, there has also been a stabilization of mortgage rates. Added to the limited supply on the housing market, the wage growth and improved borrowing capacity, plus increased consumer confidence and available equity of moving homeowners, we have all the ingredients for house prices to rise sharply.

Two out of three homes sold above asking price

For home buyers, competition in the housing market is very tight. Buying without overbidding is almost impossible in many areas and potential buyers are increasingly faced with the necessity to bid without reservations. Nationwide two out of three sold properties have been overbid. On average 4.3% more is paid than the asking price.

House sales are accelerating

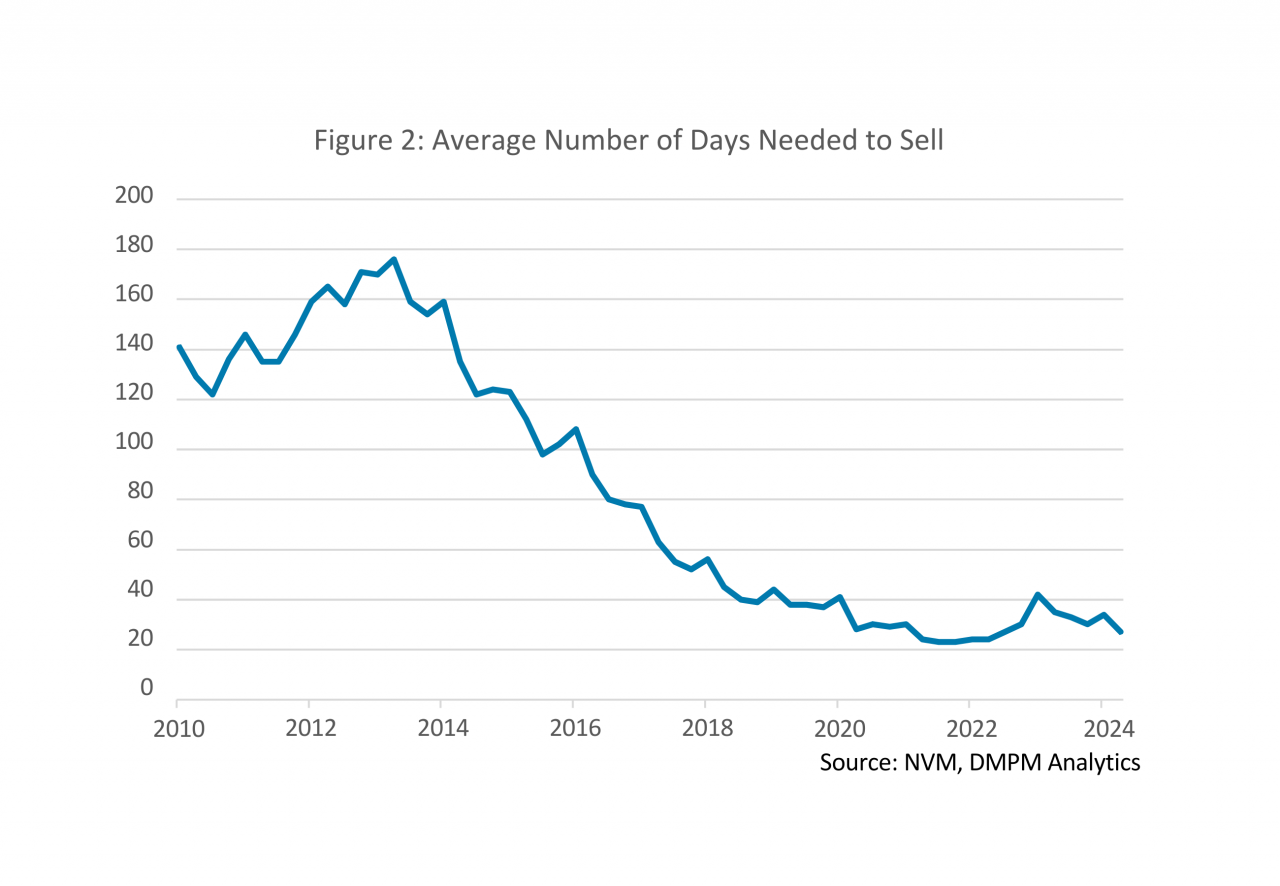

The time it takes to sell a house shortens. It takes an average of 27 days from the moment the house is put up for sale to the signing of the deed of sale with the real estate agent. This is historically fast. Only in the period 2021-2022 the average selling time was slightly shorter at 23 days.

Housing shortage continues to rise

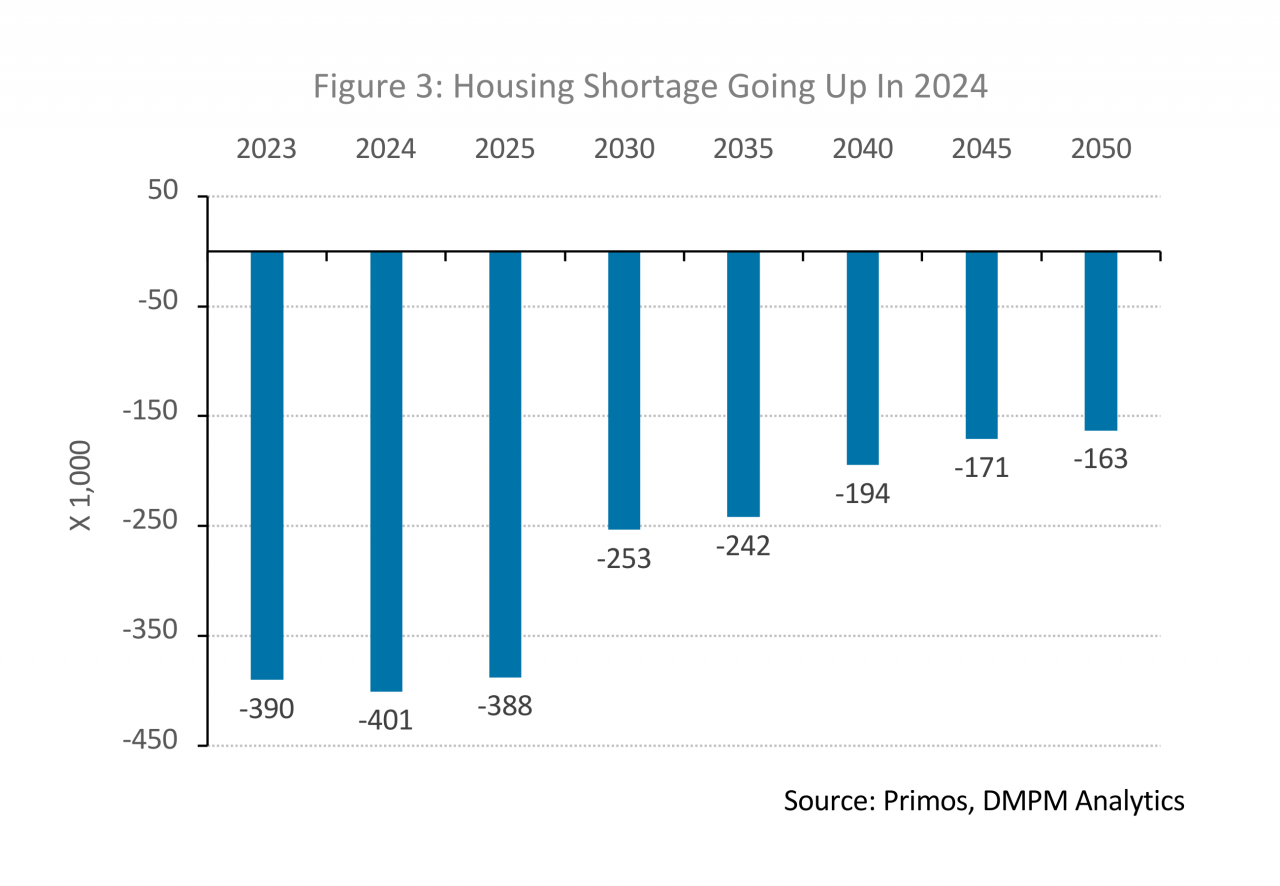

Opposite the positive developments as mentioned above, the housing shortage continues to grow. Currently there is a housing stock shortage of 400,500 units, 10,300 more than last year. Due to migration and an increasing number of single-person households, the total number of households is increasing. As a result the shortage has reached 4.9% of the total stock.

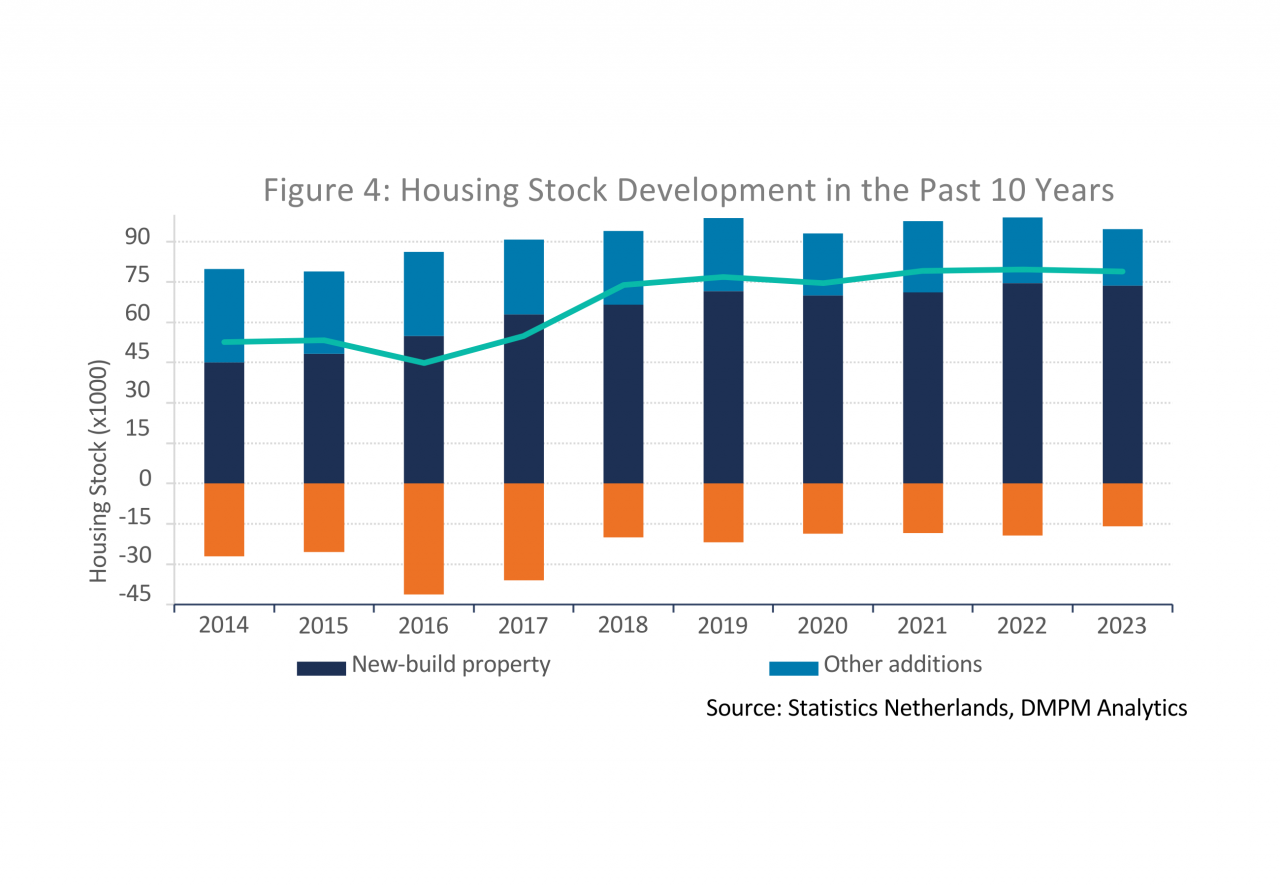

The current target is to build an additional 100,000 housing units annually, which seems challenging. When zooming in on the housing stock balance over the past 10 years, the maximum stock increase was 79.649 units achieved in 2022. In that year also the highest number of new properties was build (74.560).

Due to higher interest rates, the lagging number of building permits, the nitrogen problem and limitations as a result of an overloaded electricity grid, the stated ambition to build 100,000 new homes seems difficult to achieve.

Positive signs from the new-build property market

New-build property is showing positive signs again. After a dip in the first half of 2023, consumers have been showing more confidence. With increasing scarcity and rising prices in existing construction, more consumers are opting for new-build property. For the second quarter in a row, sales momentum is high.

Despite increasing momentum, prices have remained stable in the new-build property market. Over a year and a half, buyers paid an average of €475,000. Strongly contrasting the sharply rising prices in existing construction. The current stabilization is remarkable as new-build property prices did rise significantly during the previous upturn in the market between 2019 and mid-2021. The stability is due to several factors. The political focus on affordable new homes is yielding more supply in lower price brackets. Moreover, the recent dip in the new-build property market, with more expensive projects selling less, has probably led to some restraint in pricing.

Parties active in the new-build property market also clearly regained more confidence. More new-build homes are being put up for sale and the wave of building plans being withdrawn seems to be over. Consumers are benefitting from a wider and more affordable supply. However, concerns remain about the limited number of new projects in the pipeline and the mismatch with consumers preferences.

Want to read more?

This article is the second chapter of our Quarterly Market Update for Q2 2024. In this report, we outline developments in the Dutch economy, the housing market and the mortgage market, and conclude with some key portfolio insights. You can download the full report here.

Would you like to receive the next Quarterly Update in your mailbox? Simply subscribe to our updates by sending your email address to info@dmpm.nl with the subject line 'Quarterly Update.'