Same old, same old in the Dutch economy, while the ECB is not in a hurry

In the second quarter of 2024, we do not see any significant changes in the Dutch economy. Trends we have discussed in our previous quarterly updates still continue and did not alter in any substantial way. The labor market is still tight, since there are more vacancies than unemployed workers in the Netherlands. This leads to higher wages and as a result inflation is also currently higher than the normal 2% the government aims for.

Door Roy van den Hatert

Portfolio manager

The housing market shows the same pattern, with more demand than supply. This leads to an increase in prices, more overbidding and (first-time) buyers having a hard time to buy a property.

Formation of the Dutch Cabinet

As we have seen in our previous reports, the Dutch elections took place on November 22, 2023. Recently, a new Dutch cabinet was sworn in with Dick Schoof as the new prime minister. It was formed by a coalition of four parties: PVV, VVD, NSC, and BBB. The total formation process took about seven months. The right-wing PVV party was on the sideline in previous cabinets, marking the current cabinet as a significant shift to the right.

The new Schoof cabinet in the Netherlands has formulated several policy goals aimed at addressing key issues, see ‘Hoofdlijnenakkoord’. Below we have highlighted a few items that are relevant:

- Economy and Employment: Restructuring the Ministry of Economic Affairs with a focus on growth and innovation, as well as stimulating employment and improving the labor market. Concretely this means less taxes on labor, creating more job security and lowering the cost of living, allowing purchasing power to increase again.

- Housing: Creating sufficient affordable housing, with a new Ministry for Housing and Environmental Planning set up to coordinate this task. There is a plan to build 100,000 new homes per year. If these goals are achieved, the housing shortage in The Netherlands should be resolved in 2050. The new cabinet has stated, however, that at least 30% of all new-build properties should be for social housing. With this decision the cabinet aims to alleviate pressure in the rental market. To further destress the rental market, the maximum rent increase is going to be limited further.

- More focus on adaptation to mitigate climate risks: The government will take more action to mitigate climate risks. Their plans include expansion of floodplain areas. River systems will be allocated additional land in flood-prone regions to accommodate increased water volumes. Another goal is centered around the enhancement of flood protection infrastructure. The Flood Protection Program (Hoogwaterbeschermingsprogramma) will undergo revisions to bolster the resilience of coastal and riverine flood defenses.

As described earlier, in our publication ‘Dutch housing market gets a boost from new coalition plans’, the plans have yet to be worked out in detail. The final plans and more specific information on the measures to be taken are not expected to be released by the new government until “Prinsjesdag” on September 17. Once this information is available, it will be discussed in the follow-up to DMPM's aforementioned publication in which we give our views on the measures and plans introduced by the cabinet.

ECB Cuts Interest Rates for the First Time in 9 Months

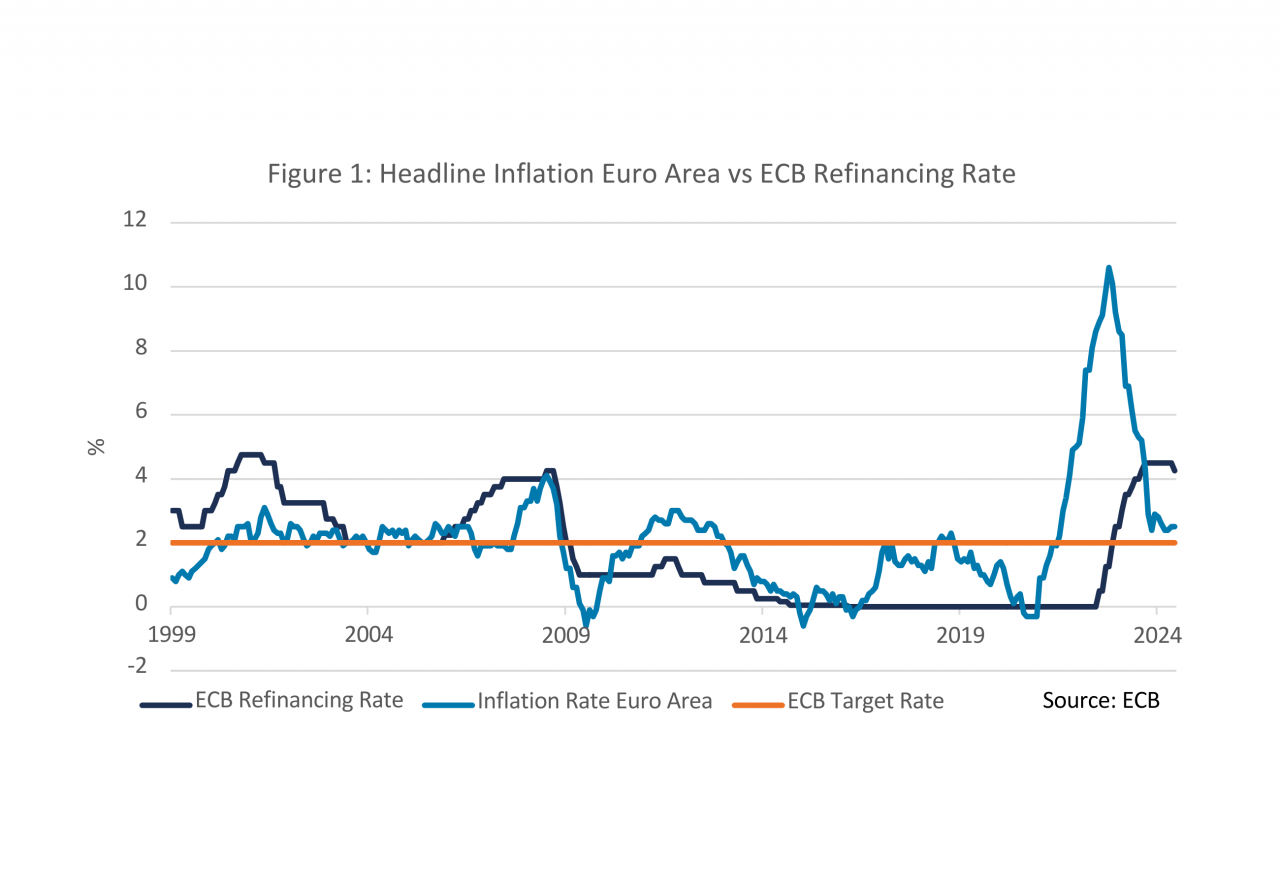

The European Central Bank (ECB) decided to cut their policy rate early June 2024, following a nine-month period of maintaining a stable refinancing rate. The Governing Council opted to reduce the key interest rate by 25 basis points, bringing it to 4.25%. This decision was primarily influenced by two key factors:

- A substantial decline in core inflation, which had decreased by more than 250 basis points from its peak.

- An improved inflation outlook for the coming years, as projected by the ECB's own forecasts.

These developments led the ECB to conclude that a moderation in the degree of monetary policy restriction was warranted. However, it is crucial to note that this rate cut should not be interpreted as a signal of further rapid reductions. E.g. the ECB's projections indicate that core inflation is expected to reach the 2.0% target only by 2026. Therefore caution is needed.

That is the ECB is not in a hurry can also be concluded from the ECB minutes (or in ECB language; The Monetary Policy Accounts) that was published on July 4. The following quote summarizes the main message: "….members also viewed risks to the inflation outlook as being tilted to the upside, partly because downside risks to inflation had diminished since the last meeting owing to the ongoing economic recovery but also owing to heightened geopolitical risks”. In other words, inflation is still a risk and it’s fully data dependent if the ECB will continue to take further steps to cut rates.

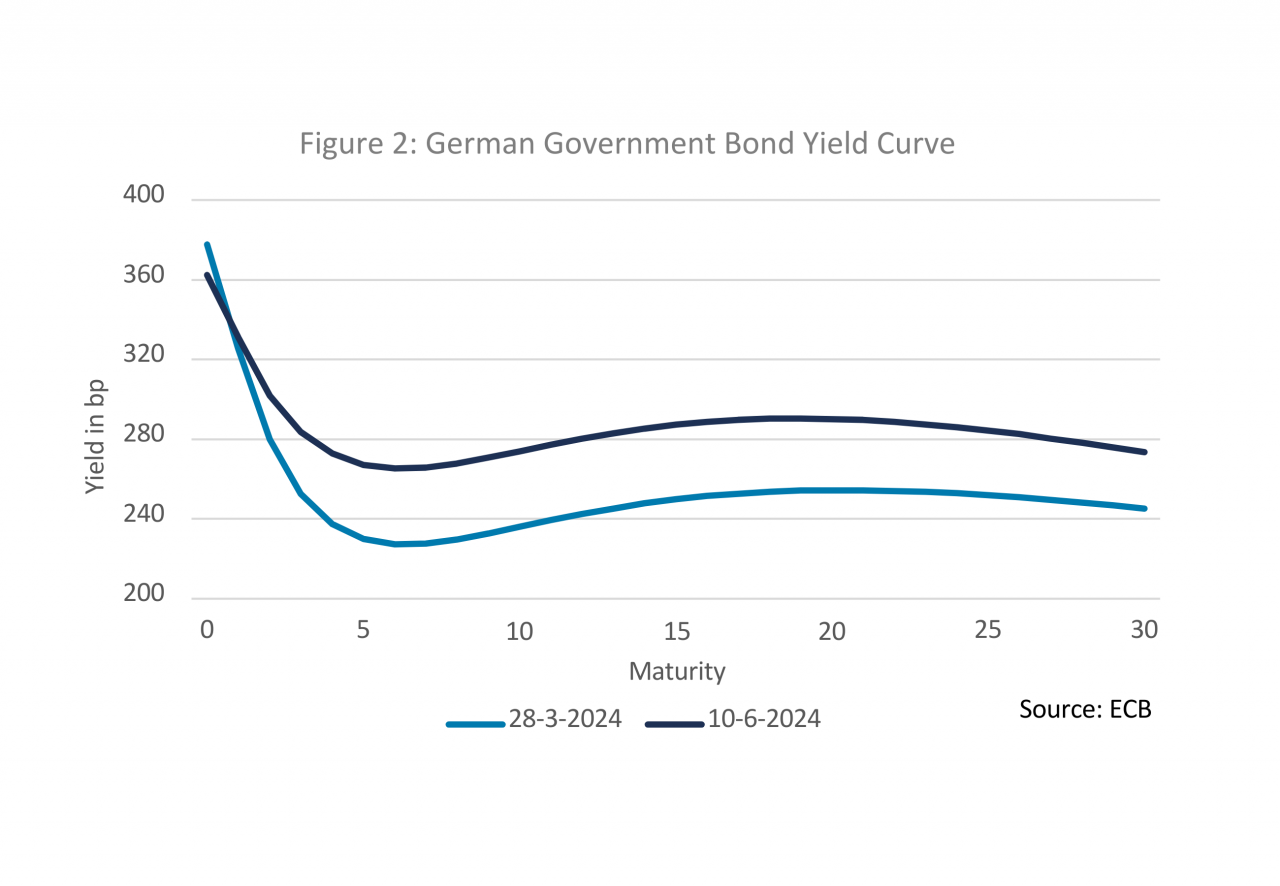

So much can also be concluded from the German government bond curve, see figure 2 above. The light blue curve depicts the curve at the end of Q1 of 2024. The dark blue curve shows the curve a few days after the ECB rate cut at the beginning of June. We can infer the following from these two curves:

- The light blue curve is much steeper than the dark blue curve at the short end, meaning that the market expected a rapid succession of rate cuts at the beginning of the year. But that’s no longer the case according to the dark blue curve, as the curve bear flattened (5-year sector moved up, while the 1-year sector remained unchanged) from the 5 year sector.

- With the exception of the very frond-end, the dark blue curve moved upward by 40bp since the end of March. Therefore, it’s an overall increase of interest rate expectations as the market adjust its monetary policy expectations.

- The 5-10 year maturity bucket remains the most attractive sector for consumers. Important note, also the swap curve is the lowest in this same maturity bucket.

The upcoming meeting of the European Central Bank (ECB) is scheduled for September, during which market participants anticipate a reduction of 25 basis points in the policy rate. However, significant uncertainty remains. The core inflation rate must decline further, and other factors, such as wage growth, also require considerable moderation to justify further action from the ECB.

Implications of the ECB’s wait and see mode

While the front end of the yield curve experienced flattening during the second quarter, it is evident that a return to a normal upward-sloping curve will require additional time. The persistence of the inverted curve indicates that a shift back to a more typical configuration is not expected anywhere soon.

The analysis of the yield curve further reveals that the 5 to 10-year maturity segment remains the most attractive for consumers. Important to note, the swap curve also reflects the lowest rates within this same maturity range. And that’s exactly what we see in the mortgage market, as the 6-10 year sector has a 70% market share, as detailed in our update on the mortgage market.

For investors primarily focused on the 5 to 10-year segment of the yield curve, this presents an opportunity in terms of volume. Conversely, institutional investors operating in the 10+ year sector may need to exercise greater patience as they await a substantial increase in application volumes. A normalization of the yield curve's shape, alongside a further flattening of the long end, will be essential to incentivize consumers to move up the curve.

So much can also be concluded from the German government bond curve, see figure 2 above. The light blue curve depicts the curve at the end of Q1 of 2024. The dark blue curve shows the curve a few days after the ECB rate cut at the beginning of June. We can infer the following from these two curves:

- The light blue curve is much steeper than the dark blue curve at the short end, meaning that the market expected a rapid succession of rate cuts at the beginning of the year. But that’s no longer the case according to the dark blue curve, as the curve bear flattened (5-year sector moved up, while the 1-year sector remained unchanged) from the 5 year sector.

- With the exception of the very frond-end, the dark blue curve moved upward by 40bp since the end of March. Therefore, it’s an overall increase of interest rate expectations as the market adjust its monetary policy expectations.

- The 5-10 year maturity bucket remains the most attractive sector for consumers. Important note, also the swap curve is the lowest in this same maturity bucket.

The upcoming meeting of the European Central Bank (ECB) is scheduled for September, during which market participants anticipate a reduction of 25 basis points in the policy rate. However, significant uncertainty remains. The core inflation rate must decline further, and other factors, such as wage growth, also require considerable moderation to justify further action from the ECB.

Implications of the ECB’s wait and see mode

While the front end of the yield curve experienced flattening during the second quarter, it is evident that a return to a normal upward-sloping curve will require additional time. The persistence of the inverted curve indicates that a shift back to a more typical configuration is not expected anywhere soon.

The analysis of the yield curve further reveals that the 5 to 10-year maturity segment remains the most attractive for consumers. Important to note, the swap curve also reflects the lowest rates within this same maturity range. And that’s exactly what we see in the mortgage market, as the 6-10 year sector has a 70% market share, as detailed in Chapter 3.

For investors primarily focused on the 5 to 10-year segment of the yield curve, this presents an opportunity in terms of volume. Conversely, institutional investors operating in the 10+ year sector may need to exercise greater patience as they await a substantial increase in application volumes. A normalization of the yield curve's shape, alongside a further flattening of the long end, will be essential to incentivize consumers to move up the curve.

Want to read more?

This article is the first part of our Quarterly Market Update for Q2 2024. In this report, we outline developments in the Dutch economy, the housing market and the mortgage market, and conclude with some key portfolio insights. You can download the full report here.

Would you like to receive the next Quarterly Update in your mailbox? Simply subscribe to our updates by sending your email address to info@dmpm.nl with the subject line 'Quarterly Update.'