Rapid increase in mortgage application volumes

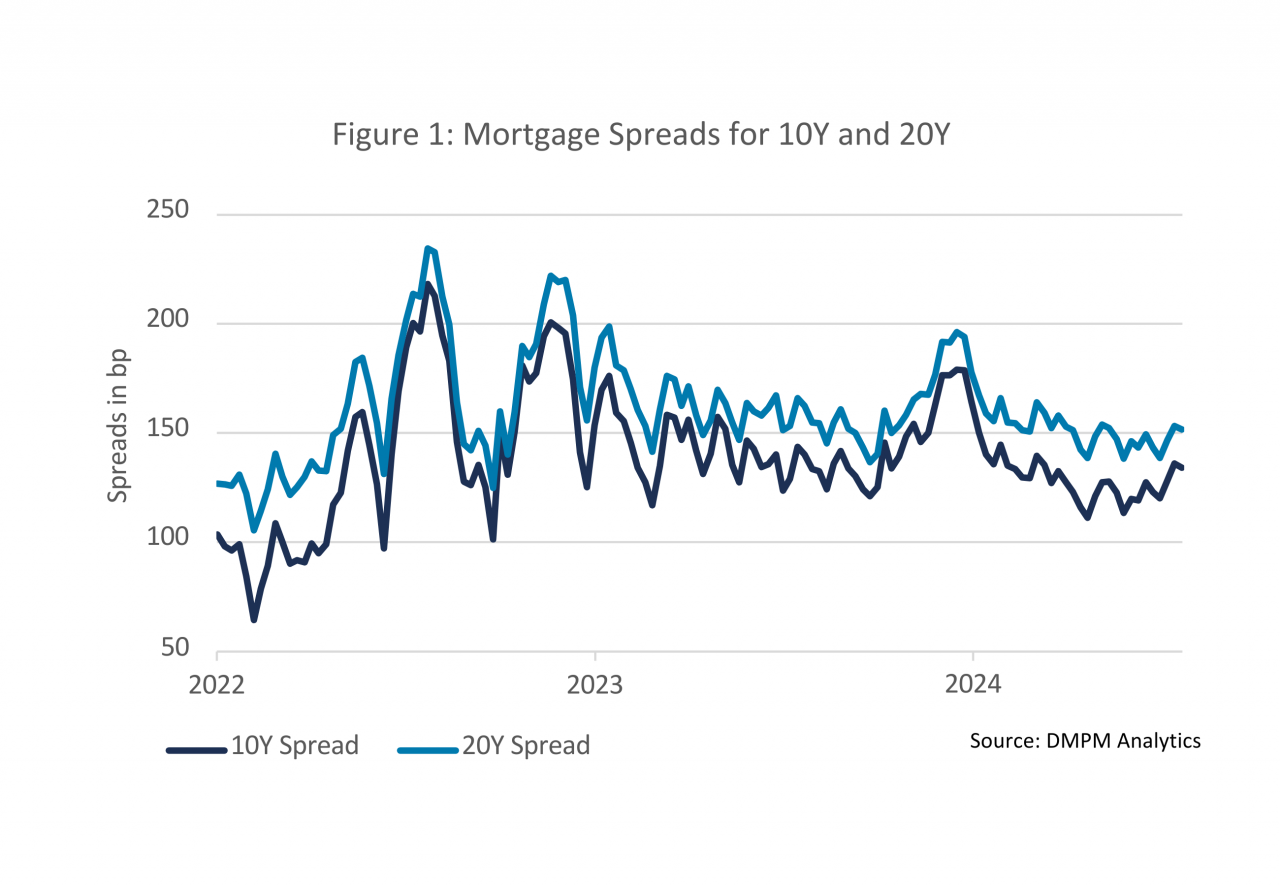

The 10-year mortgage spread has fluctuated within a range of 70bp, from 110 to 180bp, since the first quarter of 2023. The 20-year moved within a channel between 140 and 200bp in that same period. As illustrated in Figure 1, both the 10-year and the 20-years spreads have recently shifted close to the middle of the range, to approximately 135 and 155bp for 100% LTV loans.

Door Marck Bulter

Portfolio Manager

Increase in mortgage applications volume continues

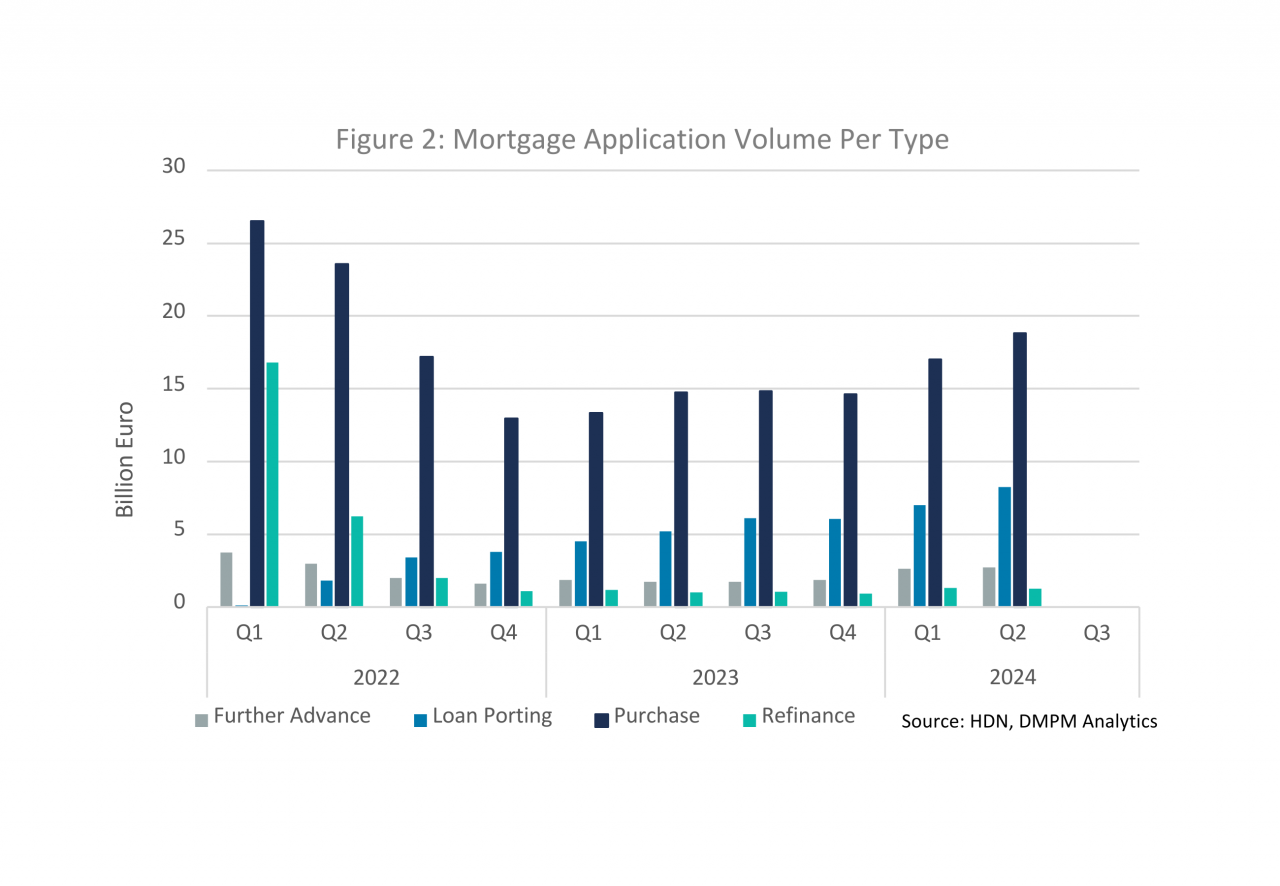

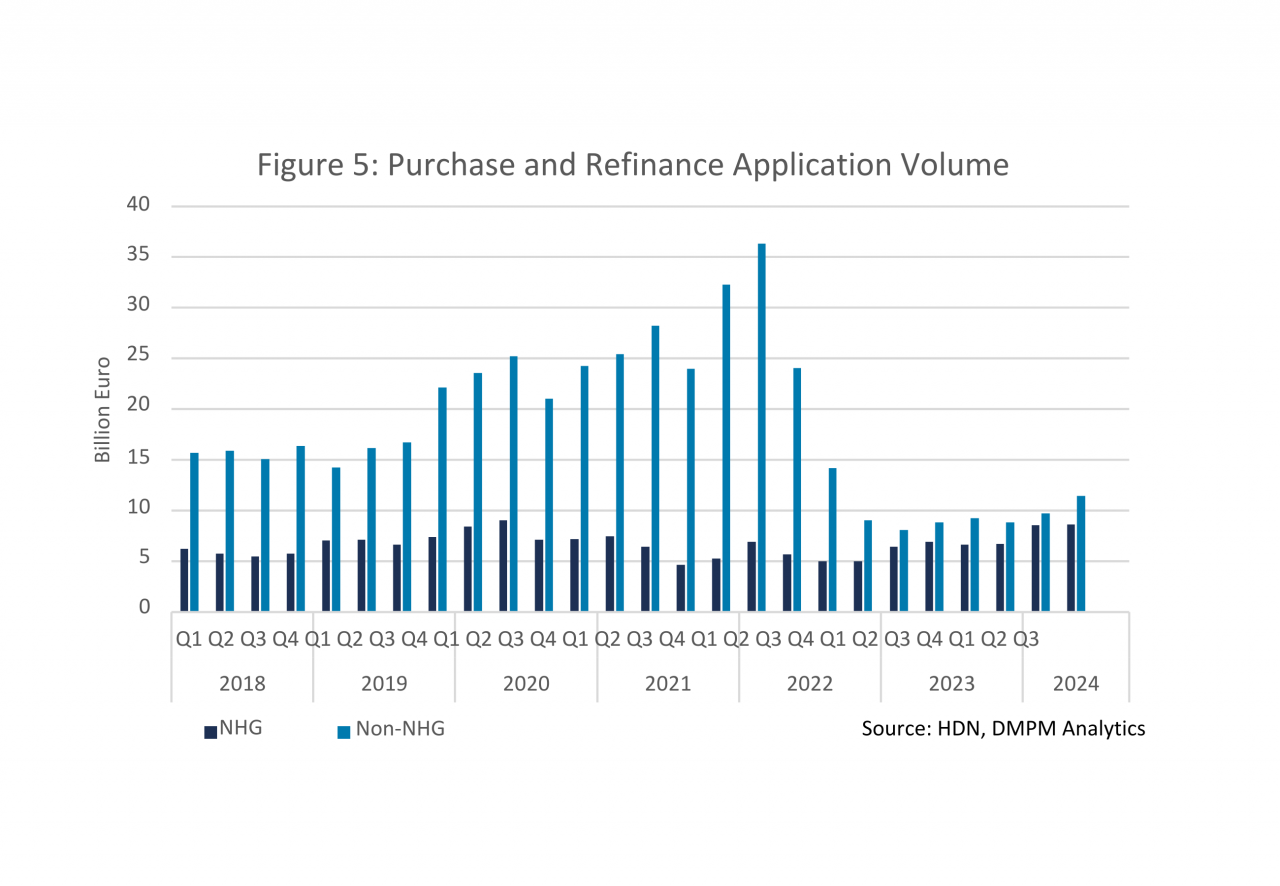

The previous chapter discussed the boom in the housing market, and unsurprisingly that had its repercussions in the mortgage application volume. Figure 2 illustrates a further 10% increase in purchase application volume from the first quarter of 2024, and a 27% increase compared to the same quarter in 2023. Although the purchase volume did not reach the record levels observed in 2022, it remains significant, with a volume of nearly €20 billion in the second quarter of 2024. Given the current relatively high mortgage rate environment, there is limited incentive for borrowers to refinance earlier than strictly necessary.

Loan Porting Jumps to a New Record

In brief, loan porting is a valuable option for homeowners with a low-rate mortgage loan, allowing them to transfer their low-rate interest contract to a new mortgage loan to purchase a new property. Homeowners with such favorable mortgage rates who wish to relocate, are likely to utilize this option. Consequently, alongside the increase in purchase application volume, the volume of loan porting has also reached a record high. In the second quarter of 2024, the loan porting volume amounted to €8.2 billion representing 26% of the total market, compared to €5.2 billion in the second quarter of 2023. The quarter-on-quarter growth in 2024 was €1.2 billion, or 17%.

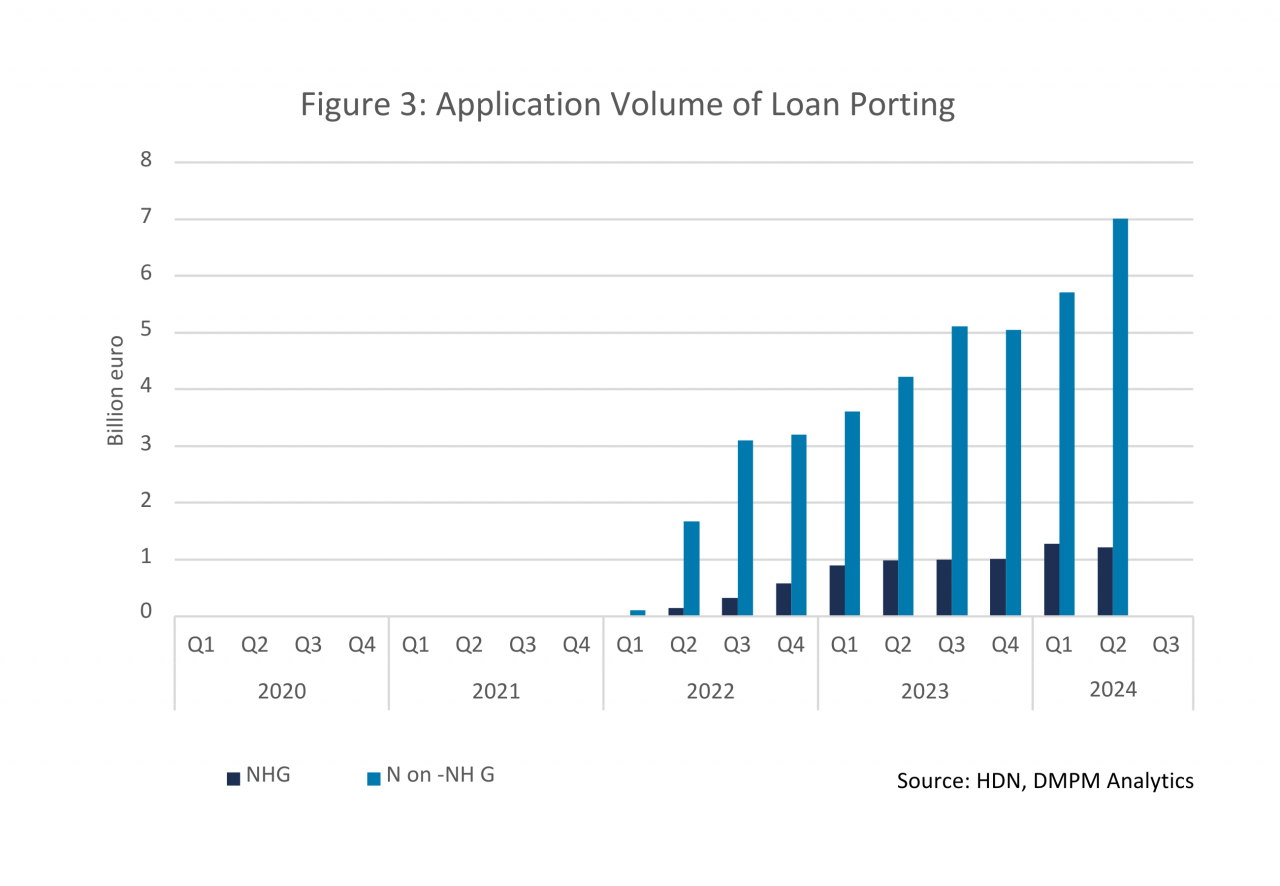

Figure 3 illustrates the distinction between NHG (National Mortgage Guarantee) and non-NHG loan porting volumes. Two significant observations can be made from this data:

Firstly, a loan porting mortgage loan is typically combined with a new mortgage loan to facilitate the purchase of a property that is likely more expensive than the previous residence. This explains the minimal growth in NHG loan porting mortgages. NHG mortgages are primarily designed for first-time homebuyers, resulting in limited financial flexibility to secure an additional mortgage on top of the ported loan. Figure 3 above also shows, although minor compared to non-NHG, that loan porting within the group of NHG mortgage loans increased in Q1 2024. This is likely the result of the increase of the maximum loan limit of NHG at the start of 2024. A nuance is needed, as the risk class of the ported loan is not known. For that reason we should be careful with firm conclusions.

Secondly, loan porting becomes financially advantageous primarily when mortgage rates have increased. This trend is clearly evident in the rapid rise of loan porting activity since the second quarter of 2022. Prior to 2022, loan porting was a rare or non-existent practice.

New equilibrium of the 6-10Y maturity bucket with a market share of 70%

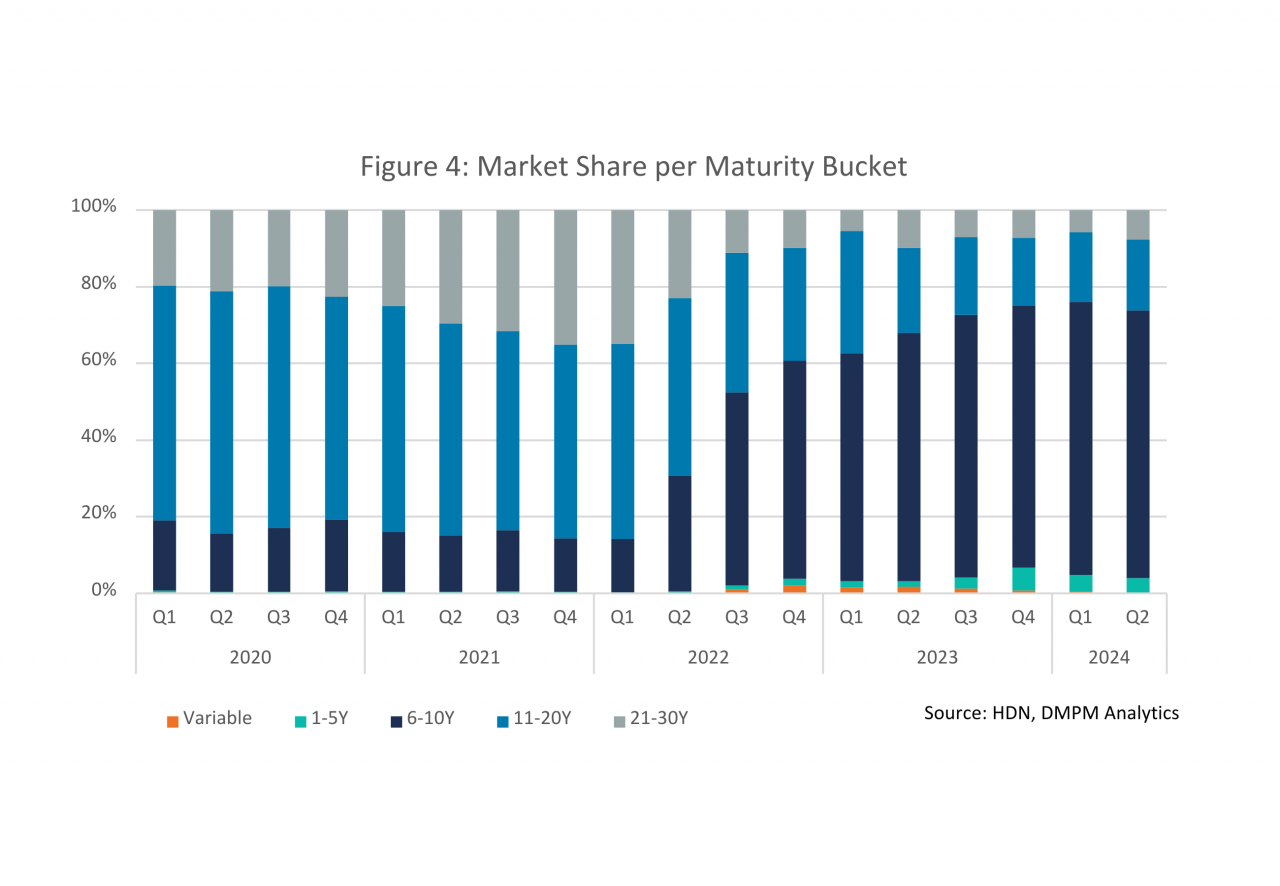

The rapid escalation of interest rates since the beginning of 2022 has encouraged a significant shift in preferred fixed interest rate periods. As illustrated in Figure 4, during the low interest rate environment up to the fourth quarter of 2021, there was a clear preference for long-term fixed rate periods exceeding 10 years. For instance, the market share of the 21-30 year maturity bucket increased from 20% in the first quarter of 2020 to nearly 40% in the first quarter of 2022. The 11-20 year sector maintained the largest market share during this period, albeit decreasing from 60% to just above 40%. The market share of the 6-10 year sector remained relatively stable at a comparatively low level of below 20%.

This paradigm shifted from the second quarter of 2022 with the rapid increases in rates. Currently, the market share of the 6-10 year bucket is by far the largest, commanding 70% of the market. The 11 year plus sector has contracted to just 20% of the market share. With the availability of data from the first and second quarters of 2024, it appears that a new equilibrium has been established, characterized by the stable market share of the 6-10 year bucket.

For market participants active in this maturity bucket, this shift presents a significant opportunity that warrants careful consideration.

NHG market advances further

Despite the year-on-year and quarter-on-quarter increases in purchase and refinance mortgage application volumes in 2024, the volumes observed prior to 2023 remain significantly higher, particularly when focusing solely on non-NHG volumes. Conversely, NHG volumes are approaching record highs. For the first and second quarters of 2024, the combined NHG volume reached €8.6 billion. In comparison, the volumes for the corresponding quarters in 2023 were €6.4 billion and €6.9 billion, respectively.

We anticipate a decrease in NHG purchase and refinance volumes in the third and fourth quarters of 2024, as the maximum loan limitation of NHG will increasingly become a limiting factor given the rapid rise in house prices. The increase in house prices is rather extreme, yet it has become more normalized, with prices increasing by 7.2% quarter-on-quarter and 13.6% year-on-year. According to the Dutch Association of Realtors and Valuers (NVM Makelaars), the median purchase price of an existing home in the second quarter of 2024 was €468,000. In comparison, the maximum loan amount for an NHG mortgage is €435,000. Although first-time homebuyers are not typically seeking homes near the median house price, it is conceivable that the availability of more affordable houses that meet the NHG restriction is becoming increasingly limited.

Read more about the NHG market here.

Rapid increase of further advances, while the share of Equity Take Out Mortgages remain unchanged

In this paragraph, we will briefly examine three trends evident in the volume of further advances and the market share of Equity Take Out Mortgages (part of a mortgage which is used as consumer credit to buy boats, cars etc). Further advances refer to an additional mortgage loan taken out on top of an existing mortgage. This new loan can be utilized for home improvement purposes or for consumption-related expenditures.

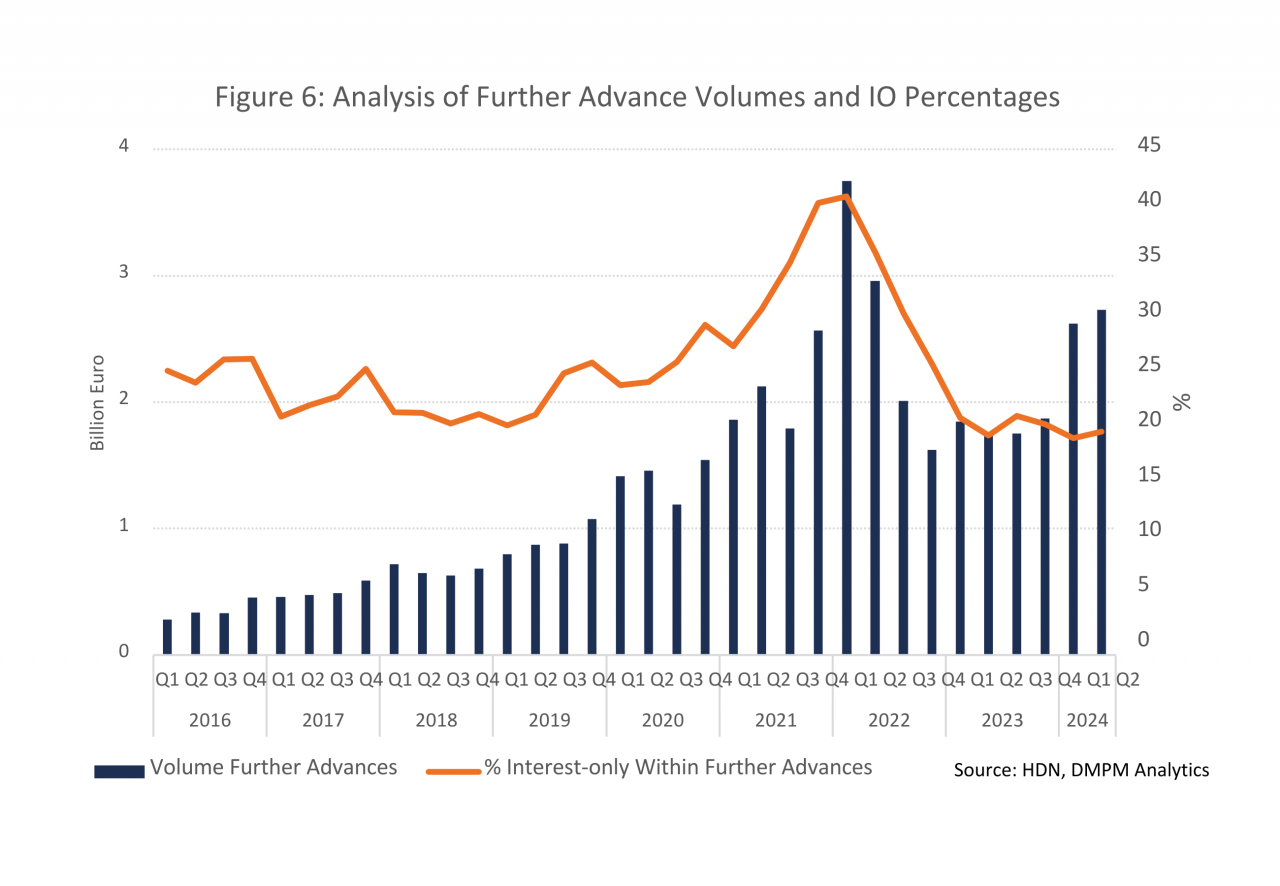

Under the Dutch tax code, the interest on a mortgage loan is tax-deductible, with the exception for an Equity Take Out mortgage. As the interest on Equity Take Out Mortgages is not tax-deductible (to the extent that the funds are not used for home improvement), borrowers typically opt for an interest-only mortgage loan to minimize their monthly installments. This approach is particularly attractive in a low-interest rate environment, where an interest-only Equity Take Out loan can be relatively favorable. To support the above visually, we have included figure 6 below. It illustrates the volume of further advances and the relative contribution of interest-only mortgages in this segment.

We begin by examining the increase in further advances during the first half of 2024, as depicted in Figure 6 (blue bars). This represents a significant increase of nearly 50% compared to the first half of 2023. Notably, the proportion of interest-only mortgages as a percentage of further advances remained unchanged. The prevailing relatively high interest rate environment is likely a limiting factor, maintaining the proportion of Equity Take Out loans at a consistent level.

Secondly, since the beginning of 2020, the percentage of interest-only mortgages among further advances rose from approximately 25% to over 40% in the first quarter of 2022. These interest-only mortgages are typically utilized as consumer credit and are particularly attractive in a low interest rate environment. However, once it became evident that interest rates were on the rise, the percentage of these consumption mortgages quickly declined to around 20%. The increase in the proportion of interest-only mortgages that began at the end of 2019 is more challenging to explain. While the initial COVID-19 lockdowns commenced in March 2020, the relationship between these events and the proportion of consumption mortgages within further advances remains somewhat puzzling. Maybe fear of missing out (FOMO) is a factor for consumers in an environment with rising rates. In this line of thought, the expectation of rising future rates, caused a proportional increase in interest-only mortgages. In other words, consumers quickly increased their mortgage before rates really became too high.

When focusing on the application volume of further advances as illustrated in Figure 6, a distinct break in the trend is observed before and after the first quarter of 2021. Although there has been a gradual increase since 2016, the volumes were relatively small at the outset. Following the first quarter of 2021, it appears that there is a lower bound of approximately €1.7 billion per quarter. In other words, it seems increasingly common for consumers to increase their mortgage loans when funds are needed for renovations or other purposes. Given the rapid rise in house prices, there is ample home equity available. Consequently, the loan-to-value ratio is rarely a limiting factor in increasing an existing mortgage.

Finally, the increase in loan porting and further advances leads to a longer duration of a mortgage portfolio. This dynamic or trend if you want, is something to take note of. And that is certainly the case for mortgage loans originated between 2019 and 2022, which will continue to prepay at a low CPR, given their low coupons.

Want to read more?

This article is part of our Quarterly Market Update for Q2 2024. In this report, we outline developments in the Dutch economy, the housing market and the mortgage market, and conclude with some key portfolio insights. You can download the full report here.

Would you like to receive the next Quarterly Update in your mailbox? Simply subscribe to our updates by sending your email address to info@dmpm.nl with the subject line 'Quarterly Update.'