- Dutch NHG mortgages are backed by the Dutch central government.

- The guarantee allows banks to benefit from lower capital requirements.

- NHG supports homeownership and provides a lifeline in case of financial hardship. These two are important criteria for the ”social element” within the ESG framework.

- NHG facilitates homeowners to make their home energy-efficient, helping investors to contribute to a positive environmental impact.

NHG mortgages: since 1995

To promote homeownership and enhance accessibility to the housing market, the Dutch central government, in collaboration with local authorities, established the Homeownership Guarantee Fund (Waarborgfonds Eigen Woningen or WEW) in 1993. Subsequently, in 1995, the WEW introduced the Dutch National Mortgage Guarantee scheme (Nationale Hypotheek Garantie or NHG). This scheme protects both homeowners and investors.

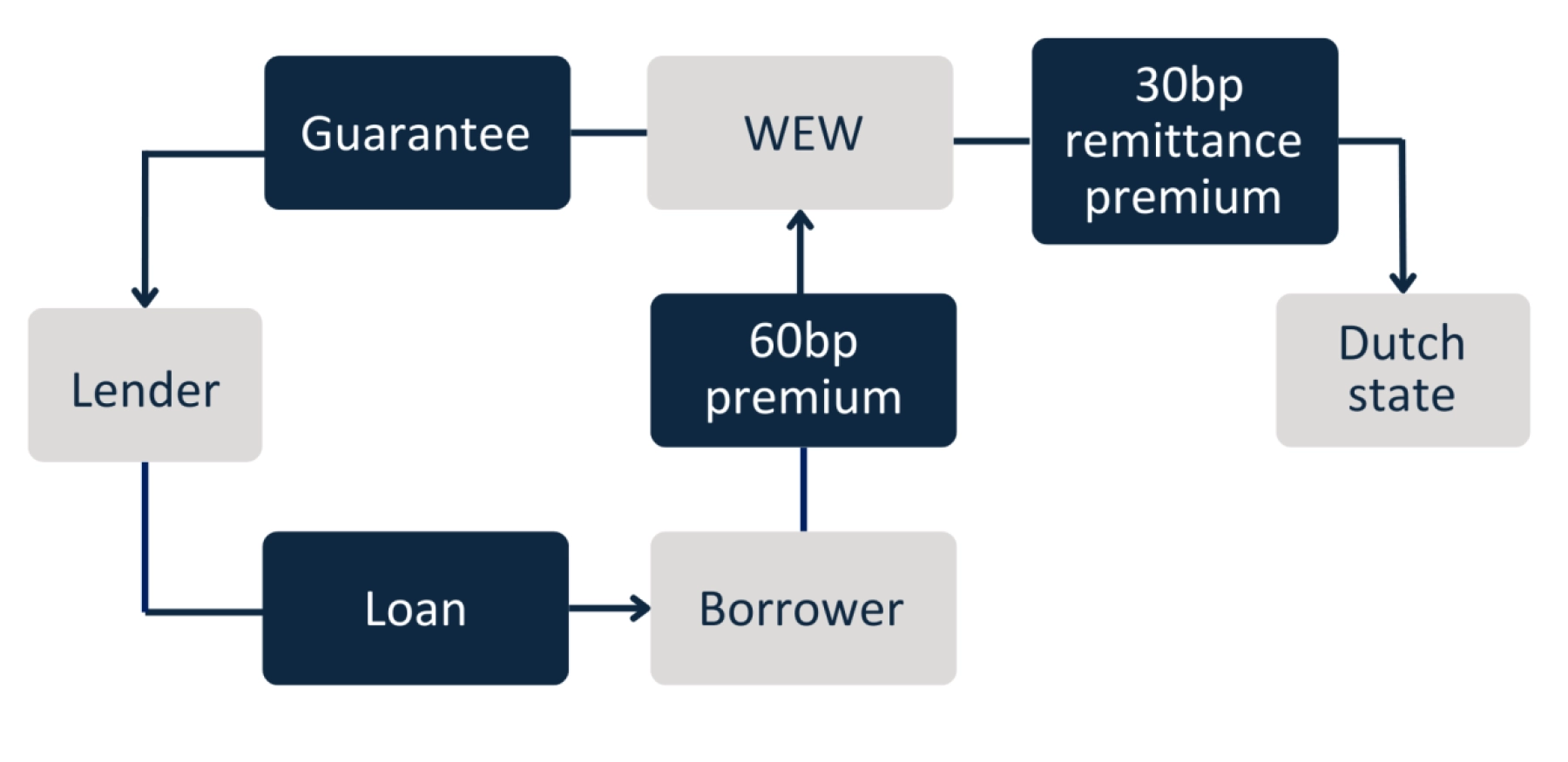

It supports homeowners in the event of unforeseen circumstances. It also protects investors in circumstances where homeowners are unable to meet their outstanding financial obligations. The scheme ensures that, in the event of repossession and sale, most of the outstanding principal and unpaid interest is covered in case of a loss. In the unlikely event that the fund is unable to meet its payment obligations, it is backed by the full faith and credit of the Dutch government, effectively providing an explicit government guarantee. Figure 1 shows how the NHG guarantee is structured. In May 2024, Moody's completed its periodic review of the WEW and affirmed its Aaa status with a stable outlook, which is consistent with the rating of the Dutch government.

Figure 1 Origination of an NHG mortgage

Dutch NHG market compared to other European countries

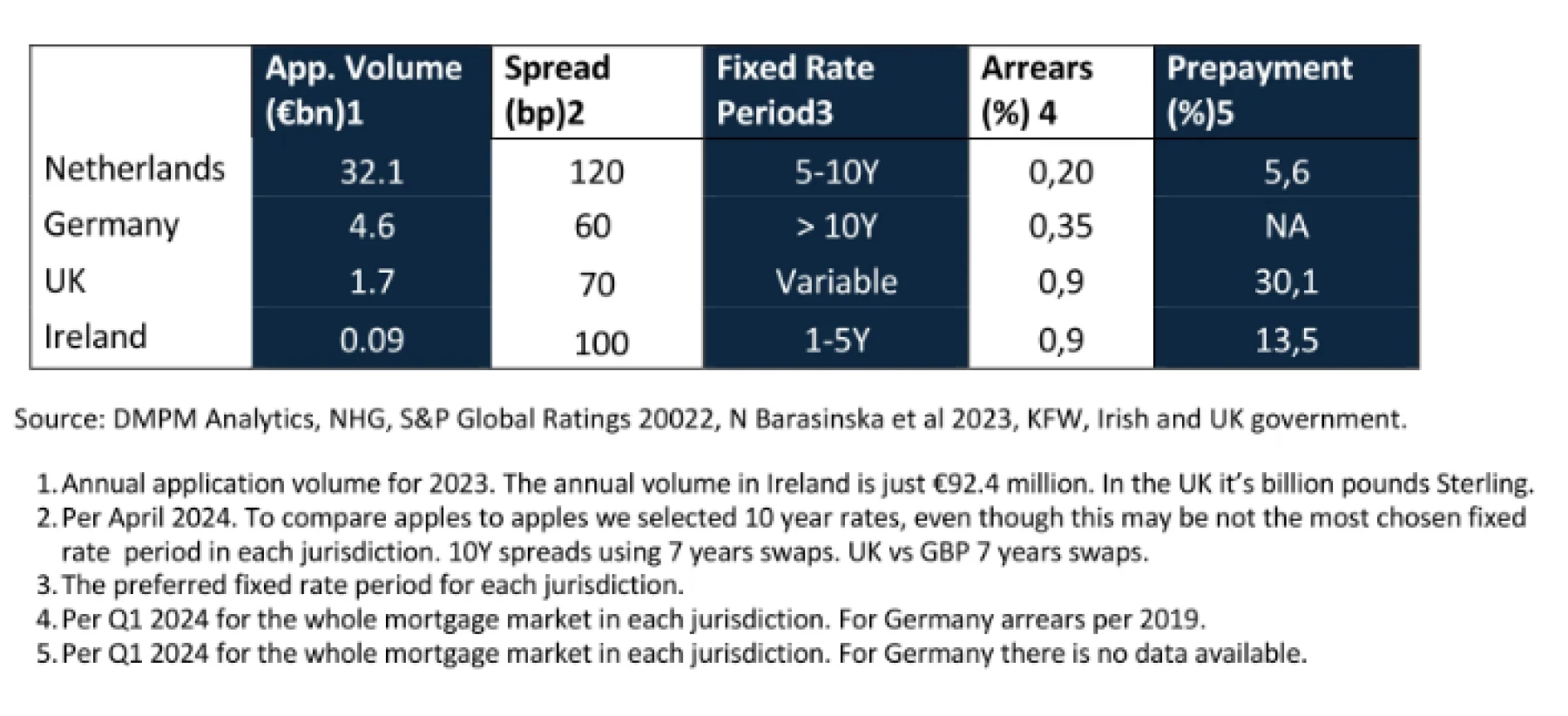

Beside, we have included a table summarising the main characteristics of the Dutch mortgage market and other European markets with a government guarantee scheme.

In the subsequent sections of this article, we will conduct an in-depth examination of the primary characteristics of the Dutch NHG mortgage market.

Comparison of mortgage markets with a government guarantee

NHG market is by comparison the most mature market

The NHG scheme stands out as a unique offering in Europe, providing a broad and accessible government-backed mortgage market. Aside from the strict affordability checks, the only broad reaching restriction is the maximum loan size of €435,000 or €461,100 (both as of 2024). The latter if energy-saving measures are implemented. Here, the maximum loan-to-value (LTV) ratio is limited to respectively 100% and 106%.

In contrast, other European countries impose more restrictive conditions on their mortgage support schemes. For instance, Ireland's Local Authority Home Loan program, which was introduced in 2022, is exclusively available to first-time buyers. In addition, it imposes a LTV cap of 90%, and enforces income restrictions.

The United Kingdom's Mortgage Guarantee Scheme, colloquially known as the 95% mortgage scheme, is a temporary initiative that will end in June 2025. The scheme was introduced at the beginning of 2021. It operates under a government-imposed cap of £3.9 billion and stipulates that the LTV must exceed 90% but not surpass 95%. Furthermore, this scheme only applies to existing properties.

In Germany, the state-owned KfW bank offers support to prospective homeowners through the KfW Home Ownership Program (KfW 124). While this scheme's primary advantage is its comparatively low interest rates, it caps the loan amount at €100,000.

These examples illustrate that non-Dutch governmental mortgage support schemes are considerably more restrictive in comparison to the Dutch NHG scheme. Therefore, the temporary nature or limited size of these non-Dutch markets makes them unsuitable for most institutional investors. The remainder of this article will focus specifically on NHG mortgages and their implications for investors.

Market share NHG mortgages increased to 35%

The Dutch residential mortgage market holds a significant position in Europe, ranking as the fourth largest after Germany, the UK, and France. With a total size of €826 billion as of Q4 2023, it represents approximately 9% of the total European mortgage market. This is particularly remarkable given that the Netherlands is only the ninth most populous country in Europe. The relatively large size of the Dutch mortgage market can be attributed to the high LTV ratios and the relatively high value of the average home.

Figure 2 demonstrates that approximately 35% of current mortgage applications in the Netherlands are for NHG mortgages. In the first two quarters of 2024, NHG applications increased by 30% compared to Q4 2023, reaching €10.4 billion per quarter. This increase in the first half of the year is a recurring annual pattern, mainly due to the annual adjustment of maximum loan amounts for NHG mortgages.

An analysis of total quarterly new mortgage applications, including both NHG and non-NHG mortgages, reveals that the total quarterly application volume in the first half of 2024 was approximately €30 billion per quarter. Figure 2 also shows a decline in the market share of NHG mortgages from nearly 30% in 2020 to below 20% by the end of 2021. This trend can be explained as follows: while the absolute application volume for NHG mortgages remained relatively constant, the absolute volume of non-NHG mortgages increased substantially, resulting in a proportional decrease in NHG market share.

Figure 2 NHG mortgage application volume in euro and NHG market share

An analysis of the market share per LTV bucket in the NHG market, as shown in Figure 3, reveals that 68% of loan applications have a LTV above 90%. In comparison, for non-NHG mortgages it’s around 40%. This relatively high percentage reflects the fact that NHG mortgages are mainly used by first time buyers. And it's a good example of the NHG's success in supporting home ownership. The 0-80% and 80-90% LTV ranges have market shares of 19% and 14%, respectively.

Figure 3 Market share per LTV bucket

Figure 4 depicts the evolution of the market share per maturity bucket. From 2020 to early 2022, fixed interest periods of 11 years or more held a market share of 80%. However, due to the rapid increase in capital market rates in 2022, there was a significant shift in the preferred fixed interest period. Currently, the 6-10 year maturity bucket has a market share of approximately 70%. This shift presents a real opportunity for investors who are primarily active in the 6-10 year maturity segment. In a forthcoming article, we will focus on this specific opportunity for banks, exploring how they can leverage the shift in maturity buckets and turn that to their advantage.

Figure 4 Market share per maturity bucket

Uncovered portion for the investor

An NHG mortgage provides safeguards for investors in circumstances where homeowners are unable to meet their outstanding financial obligations. However, it is important to note that the NHG guarantee does not fully cover the outstanding claim of the mortgage lender in the event of a default and foreclosure. The maximum percentage covered by NHG is 90% of the outstanding claim.

The accumulated loss is determined by summing up the following items:

- The difference between the mortgage amount and the proceeds from the sale of the property.

- The sum of unpaid interest, which can accumulate to a maximum of 12 months in case of a foreclosure or 24 months in case of a normal or forced sale, calculated from the start of the last unpaid interest amount.

- Interest on the total amount of unpaid interest payments for a maximum of 12 months.

- The total amount of insurance premiums for damage caused by fire or weather that is not paid by the homeowner.

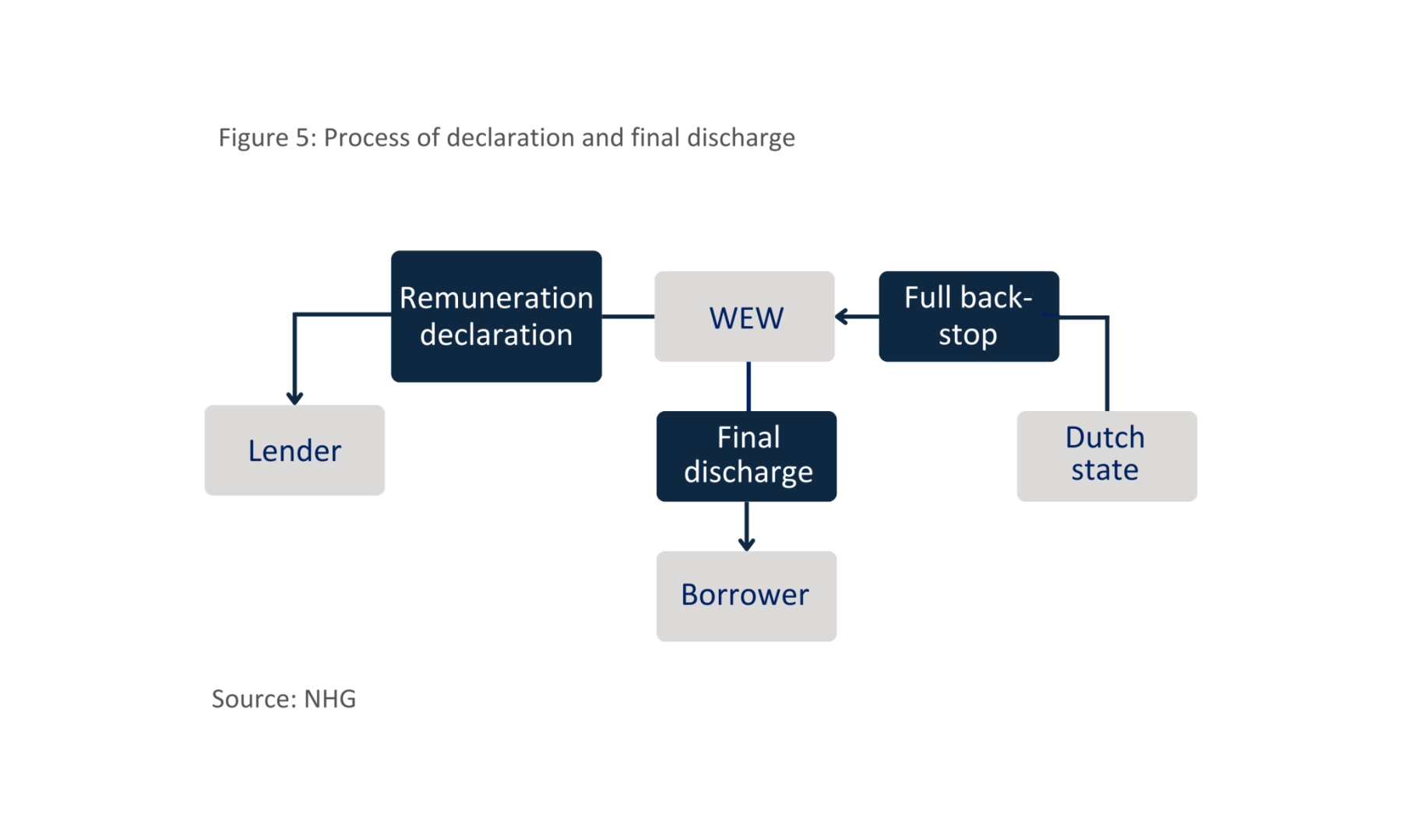

NHG performs the necessary valuations and calculations to determine the incurred loss. The sum of these four items minus 10% is the amount that will be paid out to the mortgage lender within two months. Figure 5 makes clear how each actor is related in the situation of a loss declaration.

Figure 5 Process of declaration and final discharge

Banks and other mortgage lenders can request payment of the expected loss under certain conditions, which is in line with the European Capital Requirements Regulation (CRR). This allows them to receive an advance payment, without having to wait for the whole process to be completed. If the expected loss is paid out, the guarantee remains in place, and any difference in value between the parties will be settled.

An important note with respect to interest-only mortgages: the NHG guarantee follows an annuity scheme, which means that the mismatch between the guarantee and the outstanding loan will increase over time. This is something to take into account if your portfolio includes interest-only mortgages. However, it should also be noted that the market share of interest-only mortgages is only 3% in the Netherlands, as shown in figure 6. Eventually this percentage will trend to 0%. In 2013 NHG changed the application requirements and as a result NHG interest-only mortgages are no longer allowed for new mortgages.

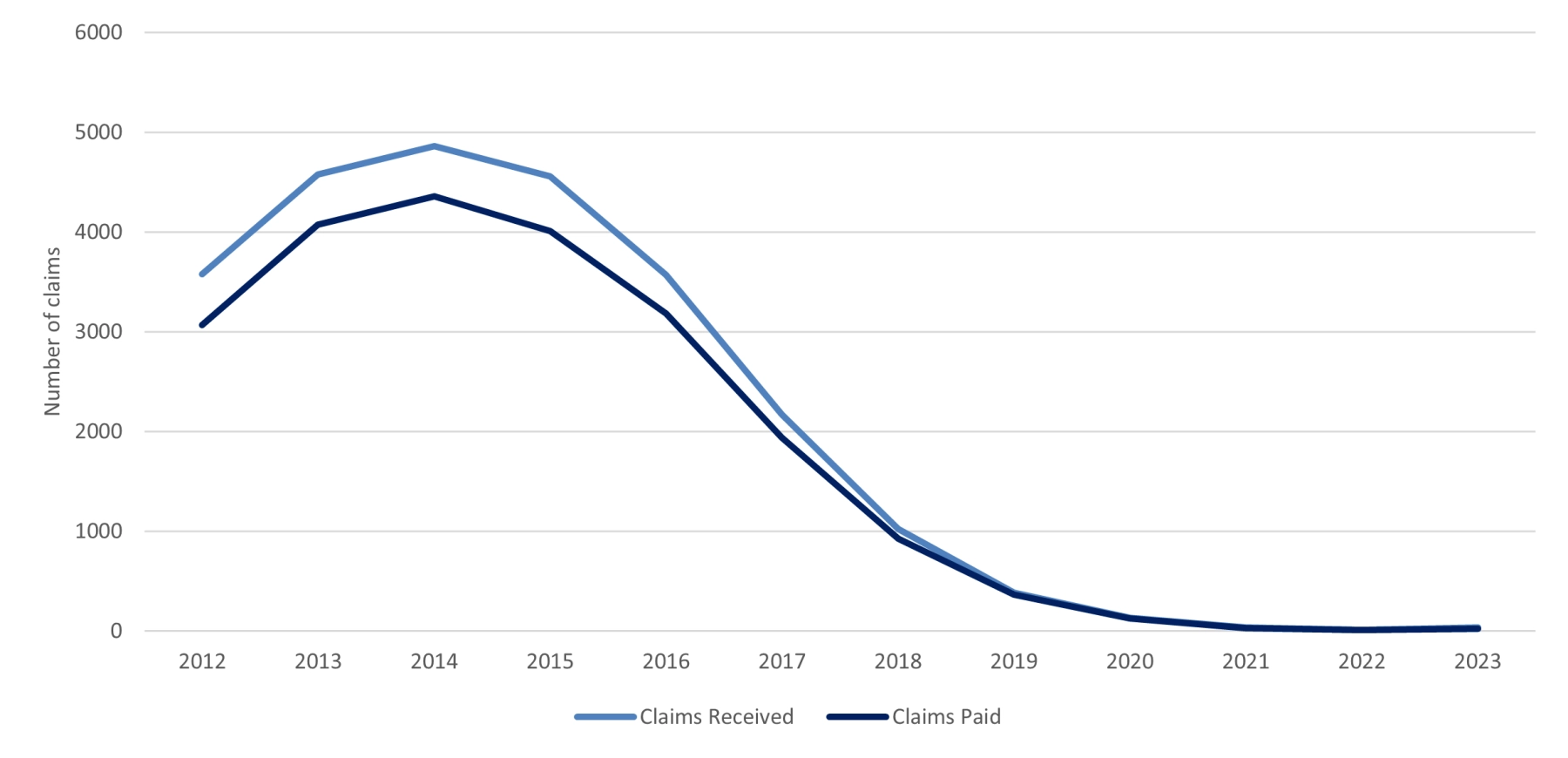

To conclude this section, we present a noteworthy statistic regarding the annual volume of loss claims received and disbursed by the NHG. In the fiscal year 2023, NHG disbursed €766,000 in claims. When compared to the guarantee fund's size of €1.7 billion, the annual claim ratio calculates to 0.05%. NHG processed 8 claims in 2022, of which all were either partially or fully paid, resulting in a payout-ratio of 100%. The payout-ratio over 2023 was only 66% This lower percentage is the result of inaccuracies in the loan application process. In none of the cases has final discharge been granted to the consumer.

Figure 6 Market share of interest only mortgages

As illustrated in Figure 7, the number of claims received has approached negligible levels since 2020. This phenomenon can be primarily attributed to the rapid appreciation of real estate values. Consequently, only a minute fraction of homeowners retain outstanding debt subsequent to the sale of their property. The same holds for claims paid.

Figure 7 Numbers of claims received vs paid by NHG

NHG: A safety net for homeowners

The NHG scheme offers a safety net for consumers under specific circumstances. The criteria for responsible lending and borrowing, which ensure that a mortgage matches the borrower's income, are set forth in Dutch law (Tijdelijke Regeling Hypothecair Krediet) and are recalibrated annually by the National Institute for Family Finance in the Netherlands (NIBUD)[3].

As mentioned previously, the NHG scheme offers several advantages to homebuyers, accompanied by a strict set of criteria:

Advantages for the homeowner:

- Attractive mortgage rates: Due to the guarantee provided by NHG to mortgage lenders, investors are inclined to offer lower interest rates on NHG-backed mortgages.

- A safety net in case of unforeseen circumstances: Both NHG and the mortgage lender work together to assist the homeowner. If the homeowner still has outstanding debt after selling their property, NHG may often cancel the residual debt.

Conditions:

- The maximum amount available for purchasing, building, or renovating a house is €435,000 (as of 2024). If the owner plans to make their home more energy-efficient, the maximum borrowing amount is increased to €461,100 (as of 2024).

- The property must be owner-occupied.

- A one-time fee, amounting to 0.6% (as of 2024) of the mortgage loan must be paid by the homeowner.

- If there are multiple NHG mortgages, the requirement is that the mortgage lender for these mortgages must be the same.

These advantages and conditions collectively contribute to making homeownership more accessible and secure for individuals in the Netherlands, while also promoting energy efficiency in the housing sector.

Preferential treatment for banks

When comparing prudential regimes, it becomes evident that only banks are permitted to consider NHG mortgages as an explicit guarantee. In addition, for the covered[4] part, the risk weighting for residential mortgages is 0%.

Insurance companies and pension funds, however, are compelled to disregard the explicit guarantee, as mandated by the Solvency II and FTK frameworks.

Notwithstanding the NHG advantage for banks, residential mortgages generally remain very capital-requirement efficient for both insurance companies and banks. For instance, in the case of insurance companies, the capital requirement for LTV ratios below 60% is 0%. For banks employing the Standardized Approach under the current Basel III regime, the capital requirement is only 4.5% for LTV ratios below 80%. From 2025, under the new Basel IV framework, the capital requirement will be even lower for LTV ratios below 50%.

In a forthcoming article, the authors will delve into the treatment of residential mortgages within the various prudential frameworks, providing a comprehensive analysis of the implications for financial institutions operating in the Dutch mortgage market.

NHG equals impact investing

The NHG scheme actively promotes the construction of energy-efficient homes and the implementation of energy-saving measures in existing properties. To facilitate this, the NHG scheme offers several incentives:

- Increased borrowing limit: The standard limit for building or purchasing a house is €435,000. However, if a homeowner invests in additional energy-saving measures, they can borrow an extra €26,100, raising the maximum amount to €461,100.

- Eligible energy-saving measures: The additional €26,100 must be spent entirely on measures such as high-efficiency glazing (at least HR++), insulation, heat pumps, or solar panels.

- Energy-efficient new construction: It is possible to build a new home with an A++++ energy label. The maximum borrowing amount for such properties is also €461,100.

- NHG promotes homeownership and as mentioned above, NHG provides a safety net in case of unforeseen circumstances where financial difficulties arise. These two are important criteria for the “social element” within the ESG framework.

These incentives aim to encourage homeowners to prioritise energy efficiency and reduce the environmental impact of the Dutch housing stock. By providing the opportunity to borrow more for energy-saving renovations or the construction of highly efficient new homes, NHG actively supports the transition towards a more sustainable housing market.

Opportunity

In summary, the Dutch National Mortgage Guarantee (NHG) market presents a substantial and attractive investment opportunity. Key factors contributing to its appeal include:

- Significant market size: The NHG mortgage market is a large and investable asset pool.

- Favourable spreads: NHG mortgages offer an attractive spread compared to swaps.

- Explicit government guarantee: NHG scheme provides an explicit guarantee from the Homeownership Guarantee Fund. This fund is backed by the Dutch government.

- Favourable capital requirements under Basel: This makes mortgages an ideal spread product for bank investors.

- Additional benefits for banks: Banks enjoy the added advantage of having the NHG guarantee recognized, which further reduces the capital requirements for holding mortgages on their balance sheets.

- Alignment with impact investing and ESG:

- NHG supports homeownership and provides a lifeline in case of financial hardship. These two are important criteria for the Social element within the ESG framework; and

- NHG actively encourages homeowners to improve the energy efficiency of their properties, providing an additional benefit for investors focused on impact investing and environmental, social, and governance (ESG) considerations.

These factors collectively contribute to making the Dutch NHG mortgage market a compelling investment opportunity for investors seeking attractive returns and alignment with sustainability goals.