- ECB rate outlook remains unclear despite inflation at target

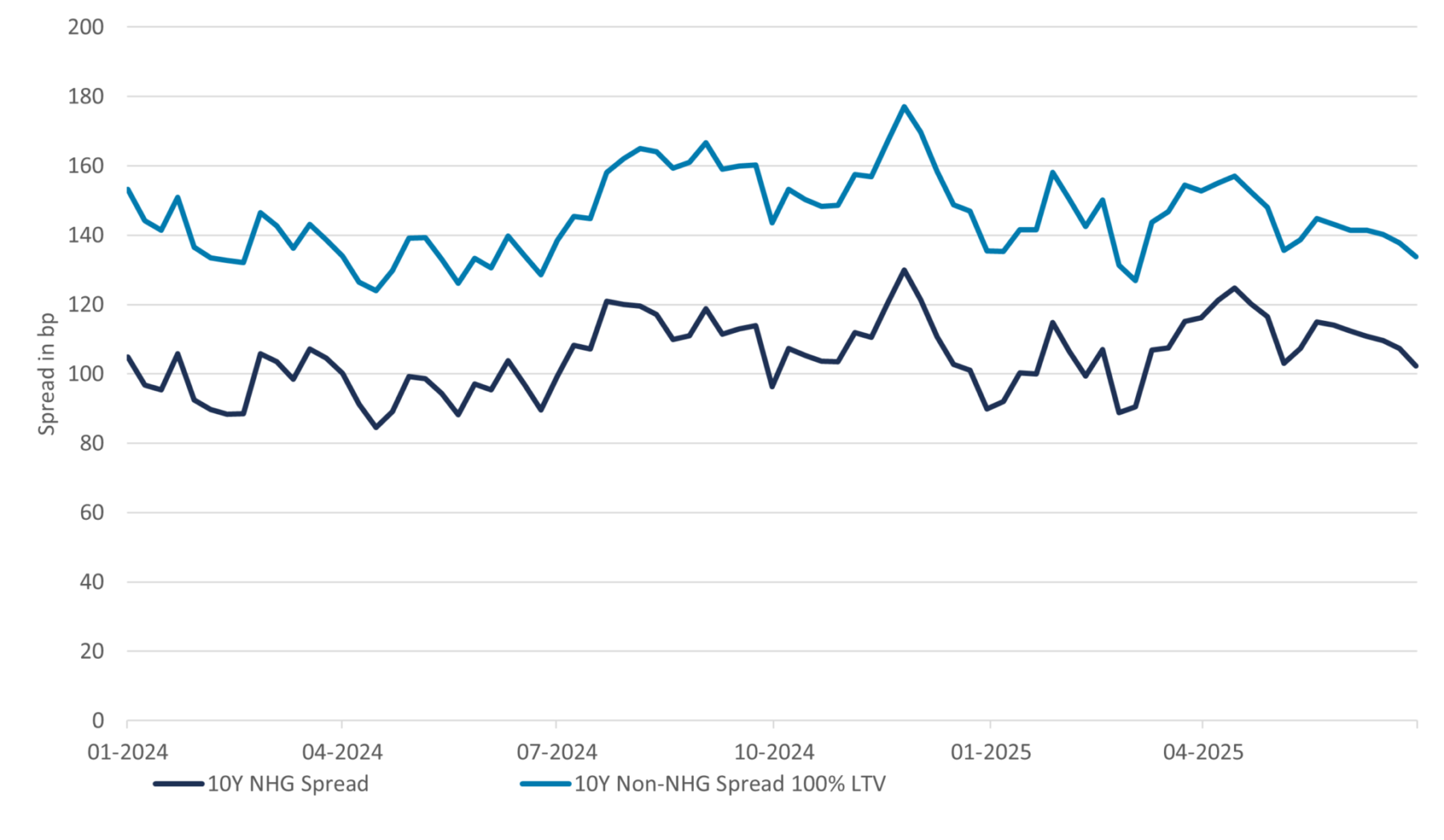

- Mortgage spreads narrow as swap rates rise

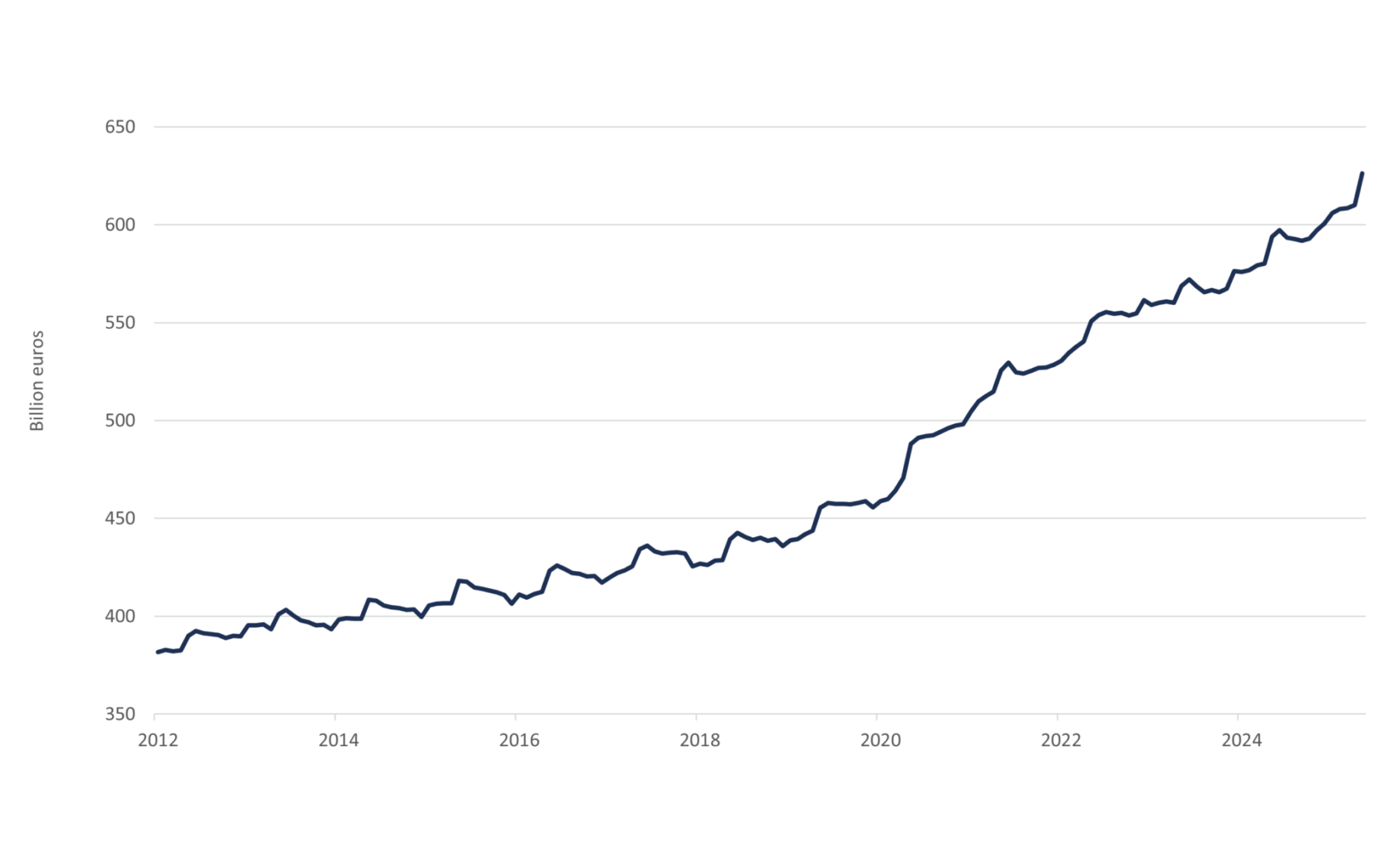

- Dutch household savings hit a record €626bn

ECB in a limbo for further cuts

With the eurozone inflation rate right at 2%, exactly the ECB’s target, the path to further rate cuts is getting less obvious. And that is exactly what can be concluded from the recent multi-directional comments made by ECB’s executive board and governing council members. ECB council member Isabel Schnabel stated that, since medium-term inflation is projected to be at 2% and inflation expectations remain stable, “the bar for another rate cut is very high”. In addition, she mentioned that the current ECB stance is accommodative, which is shown by the recent bank lending survey where, 56% of banks reporting that interest rates are boosting the demand for mortgages, while only 8% say they’re holding demand back”. On the other hand, Panetta, the governing council member from Italy is advocating for more future rate cuts if weak economic growth further fuels disinflationary pressure. With the ECB deposit rate currently at 2%, it remains to be seen what the ECB will do during the next meeting on the 24th of July.

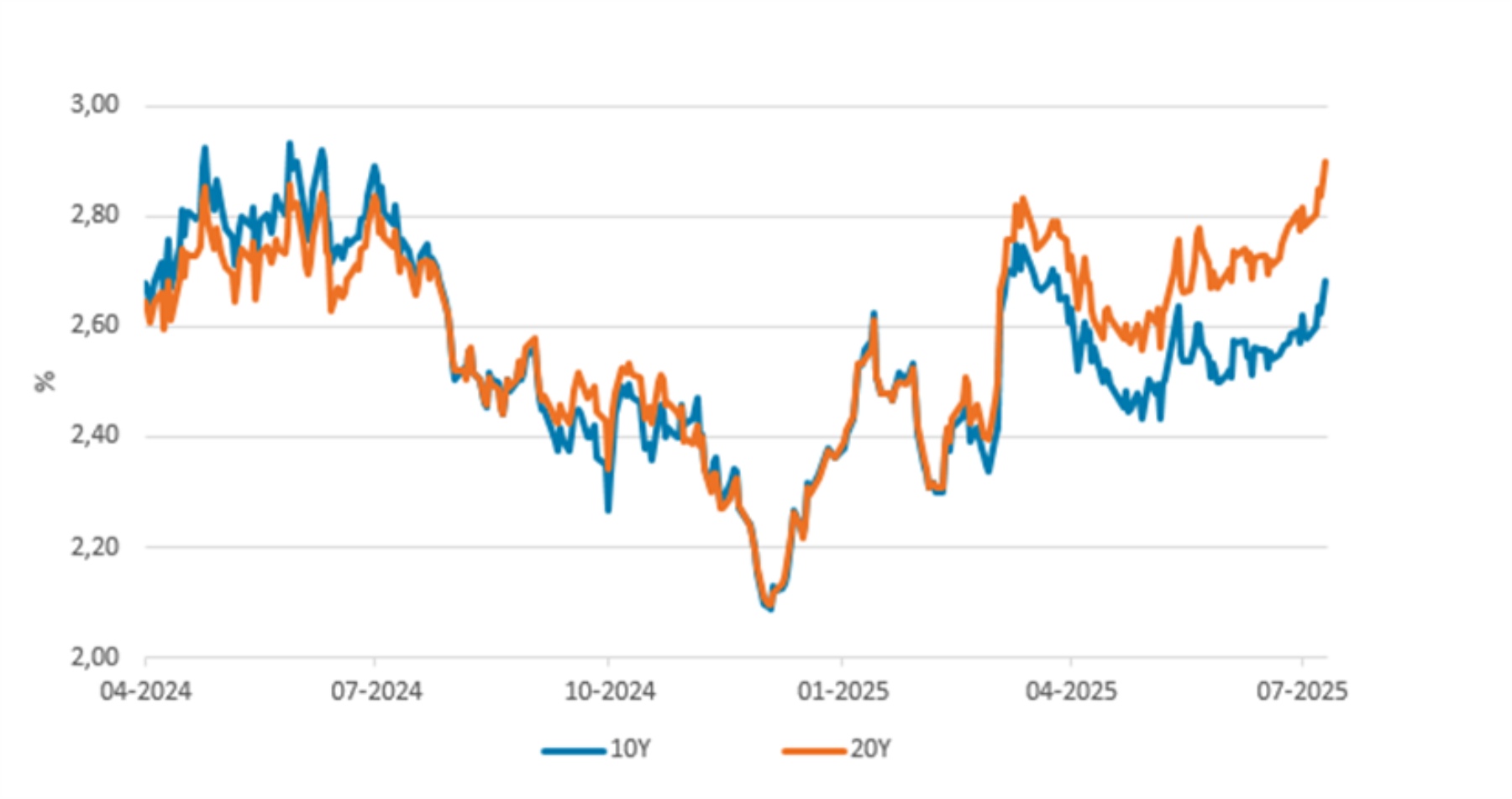

Markets increase inflation risk premium

Short and medium-term inflation are undergoing downward pressure caused by weak economic growth and the rapid appreciation of the euro vs the dollar. Judging from the 20bp increase in euro government bond yields since the start of June, markets are increasing risk premiums in case the US and EU can’t negotiate an attractive trade deal. Last week president Trump announced that the import tariffs for all EU goods to the US will be set at 30% starting from August 1 and any countermeasures will be met with another 30% above the new EU tariff. EC President von der Leyen responded by saying that Europe prefers cooperation rather than confrontation. But, she also made clear that she is ready to adopt countermeasures if needed. Preparing for higher future inflation rates, markets prepared for the worst and government bond yields increased across the board, and swaps rates followed suit, see figure 1. Dutch mortgage rates have not responded as of the 7th of July to the increase in swap rates. As a result mortgage spreads decreased to approximately 100bp for 10 year NHG from 115bp at the start of the quarter.

Figure 1: Swap rates

Source: DMPM analytics

Figure 2: Dutch 10 year mortgage spreads

Source: DMPM analytics

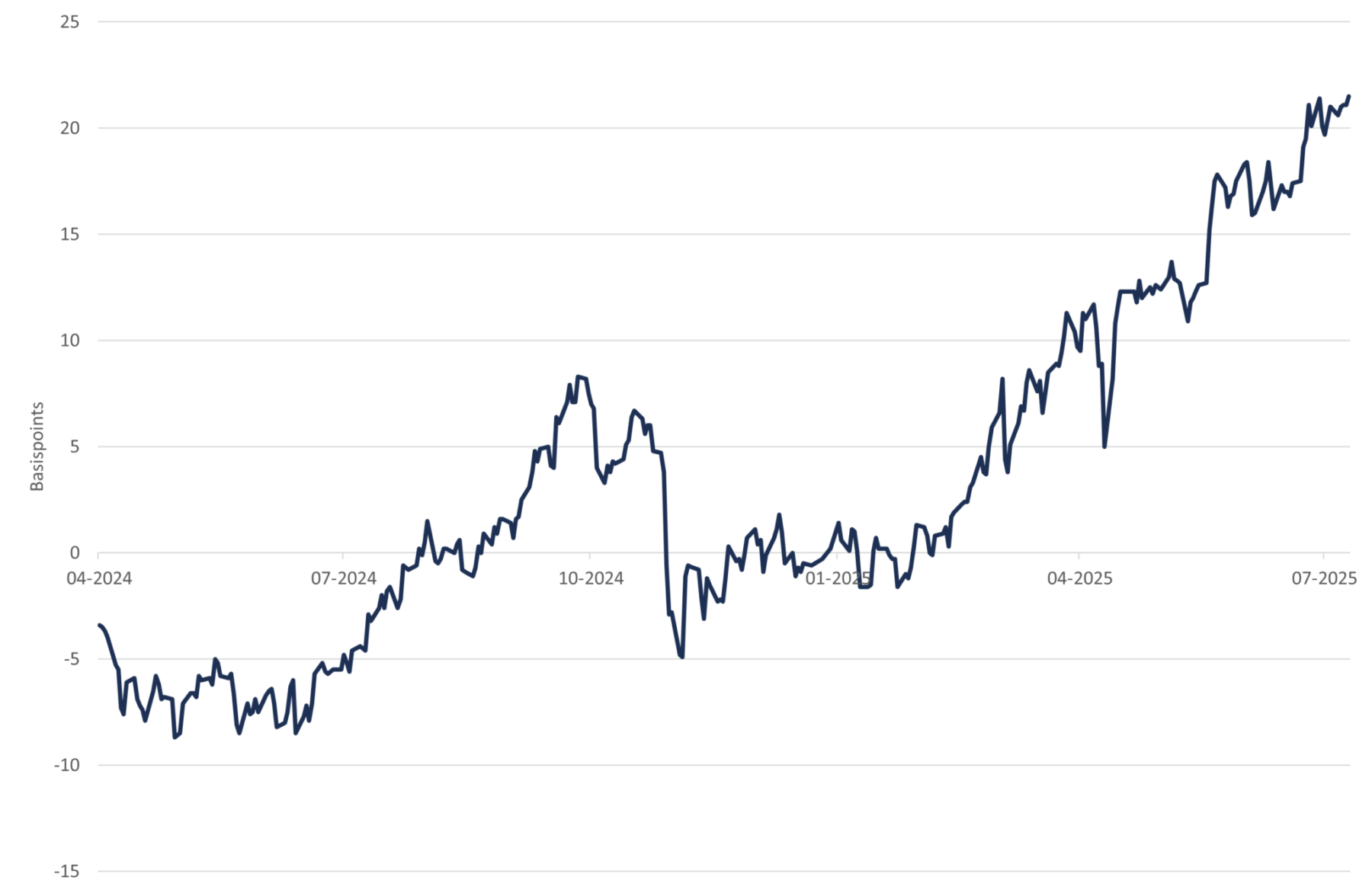

Swap curve steepening continues

In the previous quarterly report we mentioned the steepening of the swap curve. This trend continued in the second quarter of 2025, as the 10-20 swap curve steepened another 10bp to more than 20bp. This increase is visible in figure 1, but more clearly in figure 3 below.

Figure 3: 10-20Y swap curve spread

Source: DMPM analytics

The marketshare of the 10 year mortgage rate tenor has increased approximately 10% to 80%, compared to the first quarter of 2025. Therefore, it seems that consumers do respond to the relatively more expensive longer fixed interest rates periods. But we should also make clear that the relation between the steepness of the swap curve and consumer preferences for certain fixed interest rate periods with regard to new mortgage applications, is fuzzy at best. There have been periods where the curve was relatively flat, together with a relatively large 10 year market share. Therefore, more research is needed to draw a firm conclusion.

Bank deposits Dutch households surpass € 600bn

Due to the significant wage growth during the past few years and the increase of real disposable income, the total size of bank deposits of Dutch households increased rapidly. In the first quarter of 2025 total bank deposits crossed the € 600bn and stand per May 2025 at € 626bn, see figure 4. This number can be split up in saving deposits of around € 515bn and current accounts of around € 111bn.

Figure 4: Dutch households bank deposits

Source: DNB, DMPM Analytics

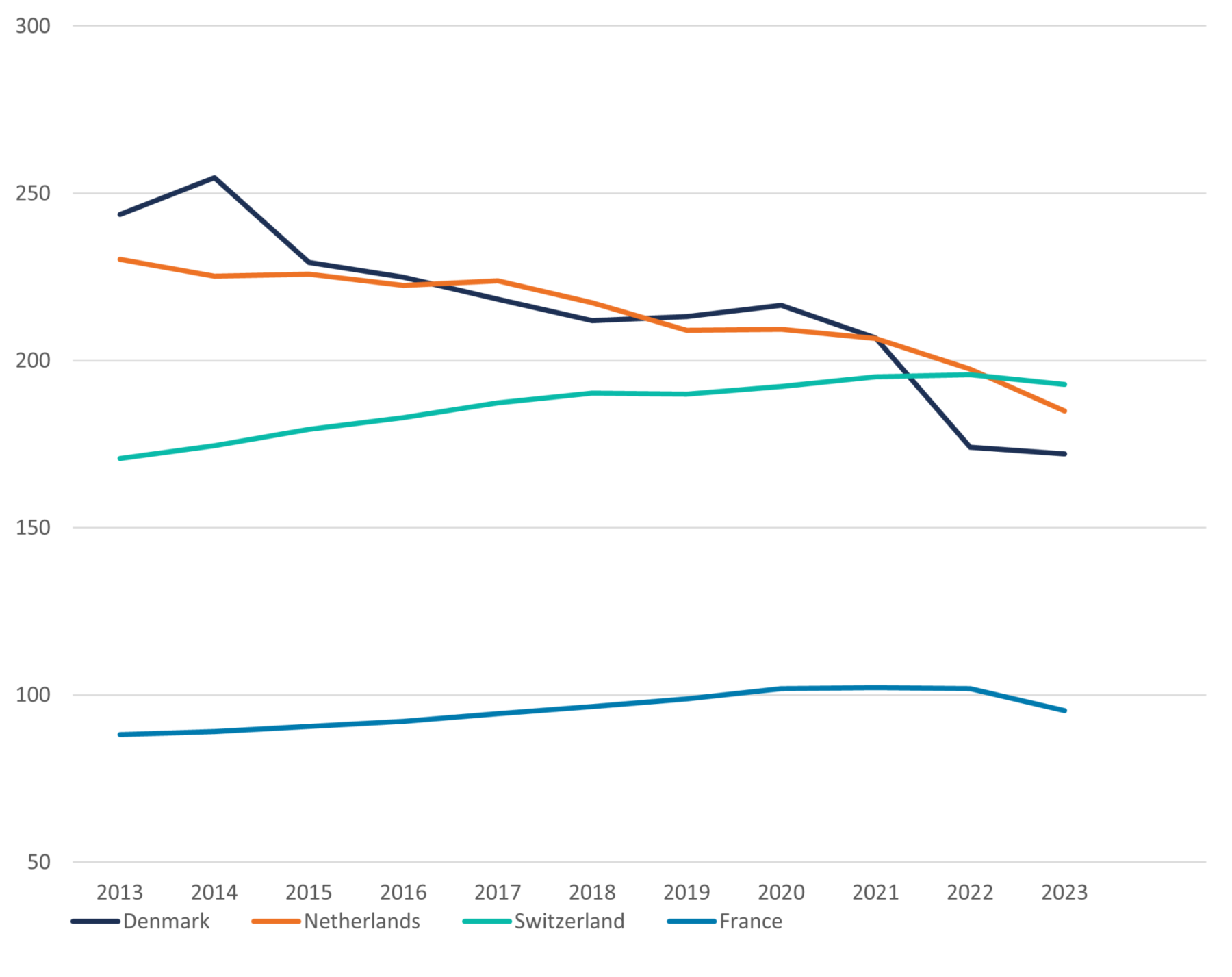

The increase of saving deposits shows that the balance sheet of Dutch households remains very solid and is even improving further. This is evidenced by the decrease of the debt to income ratio of Dutch households, see figure 5. In 2013 this ratio was at 243, and 10 years later it decreased to 172. It’s fair to say that a debt to income ratio between 175 and 200 is still high, but apparently that’s pretty normal among the richest countries in the EU.

Figure 5: Debt to income ratio households

Source: Eurostat

For investors in Dutch mortgages it shows that the Dutch mortgage market is rock solid, and the credit risk fundamentals are getting even stronger. The high payment morale and the very low percentage of arrears is typical for the Dutch market.

Want to know more?

This article is the first chapter of our quarterly market update for Q2 2025. In this report, we outline developments in the Dutch economy, the housing market and the mortgage market.