- Recent policy measures have significantly influenced both the rental and owner-occupied sectors, with some unintended consequences.

- Ongoing supply shortages continue to exert upward pressure on house prices and deepen the housing deficit.

- Foundation vulnerabilities and fiscal uncertainty introduce additional challenges to an already tight housing market.

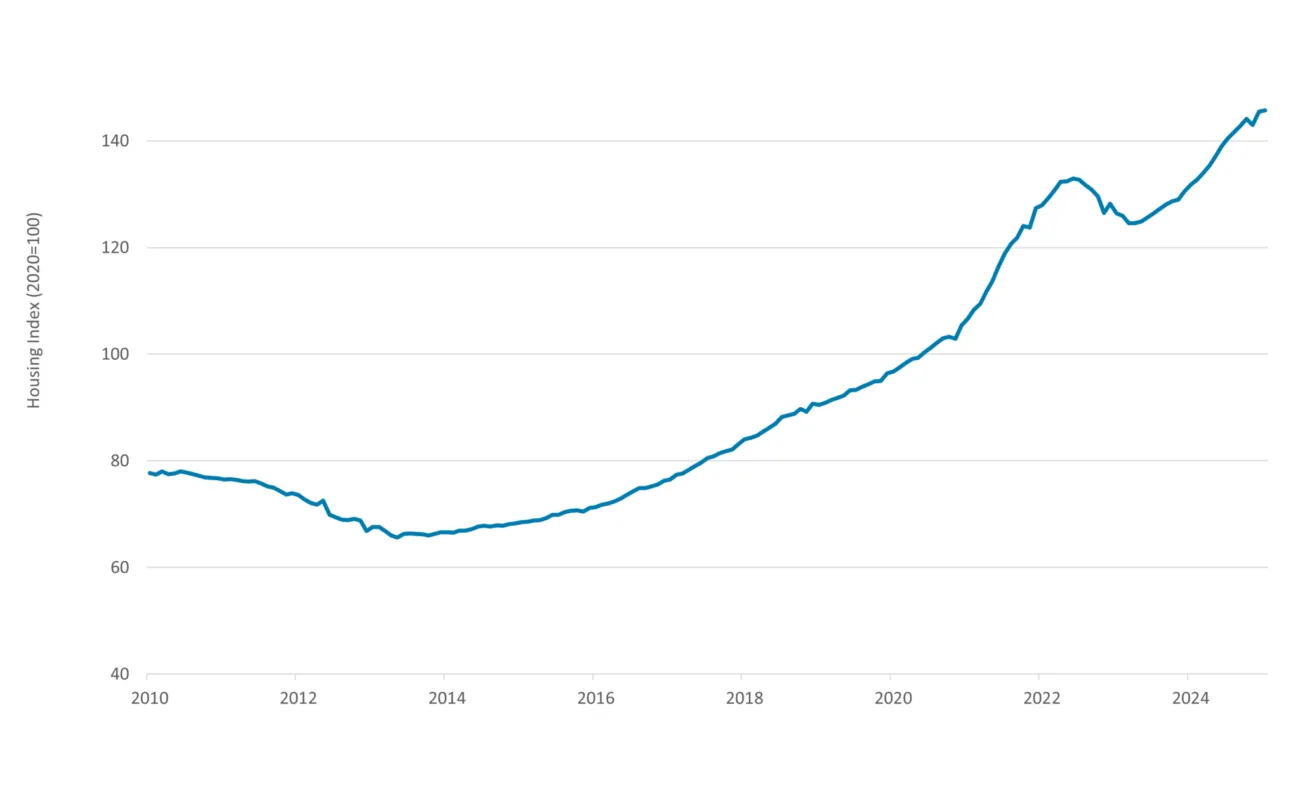

In the first quarter of 2025 we’ve seen that the trend from previous quarters continued. The housing market remains extremely tight, which will drive up house prices, see figure 8. Dutch major banks ABN AMRO (+7%), ING (+5.5%) and Rabobank (+8.6%) all expect house prices in the Netherlands to rise in 2025. Government decisions from 2024 have impacted the rental and buyers housing market, but the biggest contributing factor to the price increase is supply and demand. Since the Dutch government isn’t able to build enough new homes every year, the housing market will remain tight and prices will rise. As discussed in our previous quarterly report, the Dutch government is lacking severely in their goal to mitigate the housing shortage. Their housing forecast for the coming years has been adjusted negatively in the previous quarter due to the inability to build enough houses to dampen the shortage.

Figure 1: House prices

Source: Statistics Netherlands, , DMPM analytics

Persistent housing shortage

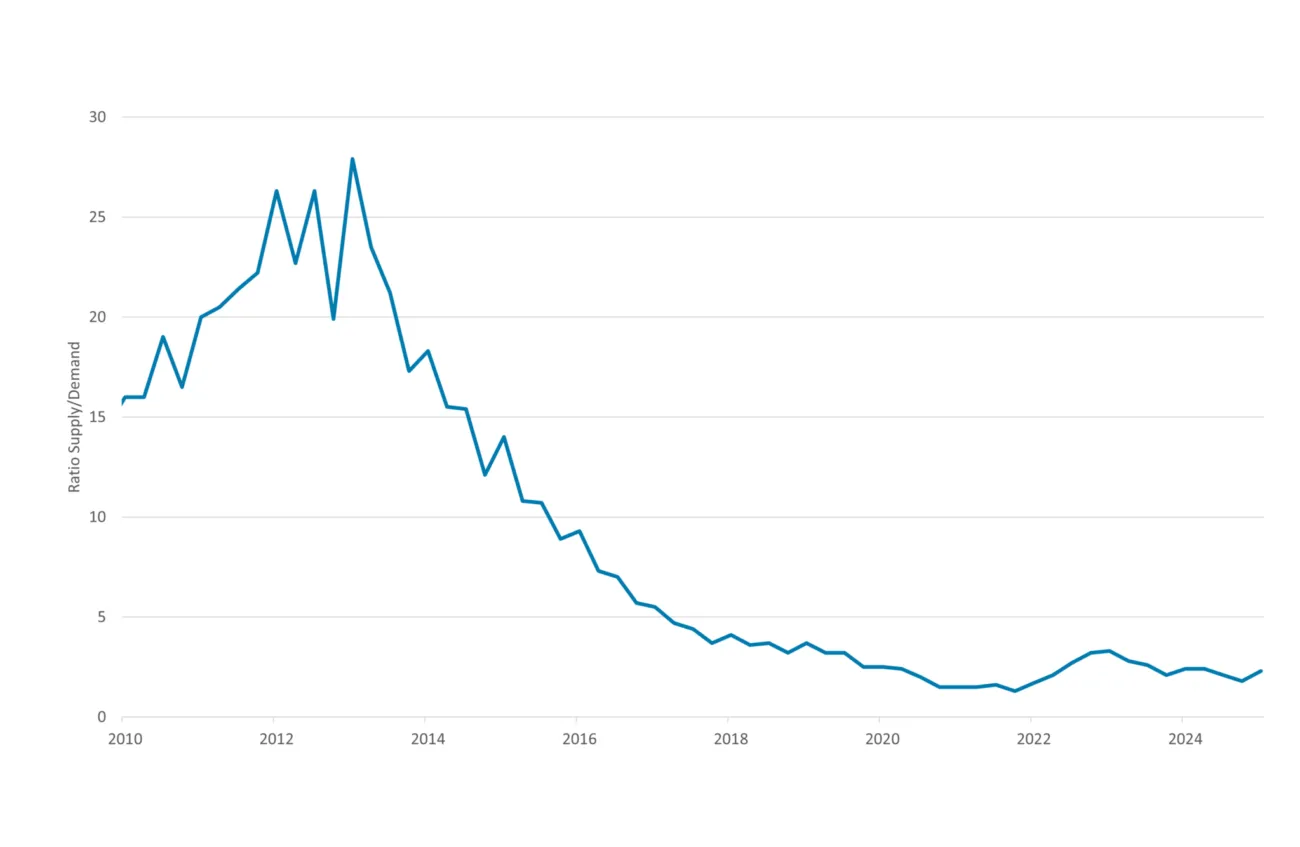

As we’ve discussed in our previous quarterly report, the Dutch government isn’t able to build enough new homes to overcome the increasing demand. The forecast they had given earlier, had to be adjusted. The new forecast shows a housing shortage of 367,000 houses in 2032 compared to the previous forecast which only showed a shortage of 253,000 houses. The disappointing levels of new construction and building permits make that the housing shortage won’t be fixed before 2050. Therefore the Housing Shortage Indicator will remain at a very low level, figure 2.

Figure 2: Housing shortage indicator

Source: NVM

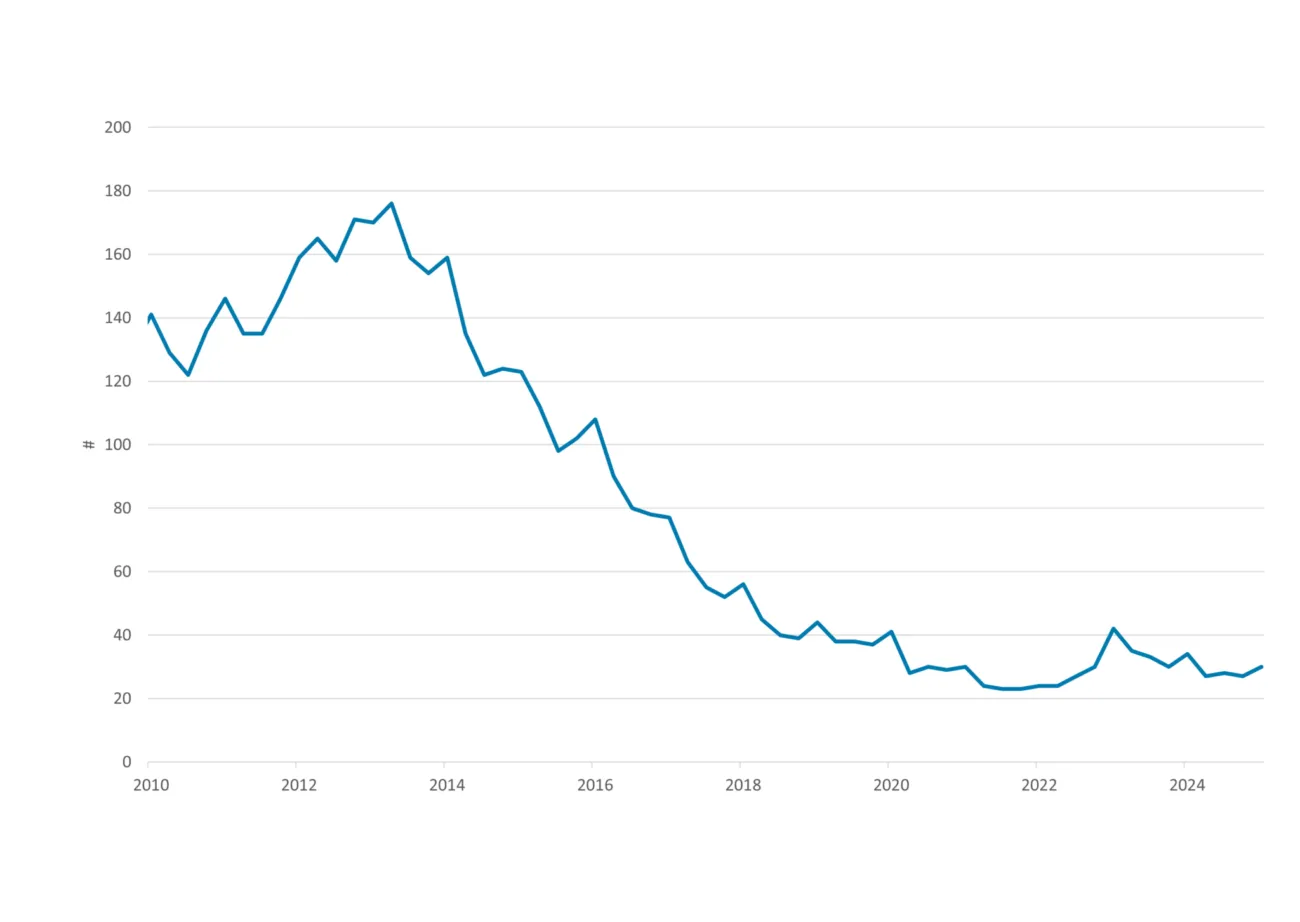

Houses sold extremely quickly

As a result of the shortage in the market, houses are being sold very fast. On average a home is on the market for 30 days before being sold, figure 10. This figure has remained stable over the last four years. 85% of all homes are sold within one quarter.

Figure 3: Average number of days needed to sell

Source: NVM

Rocky start for Affordable Rent Act

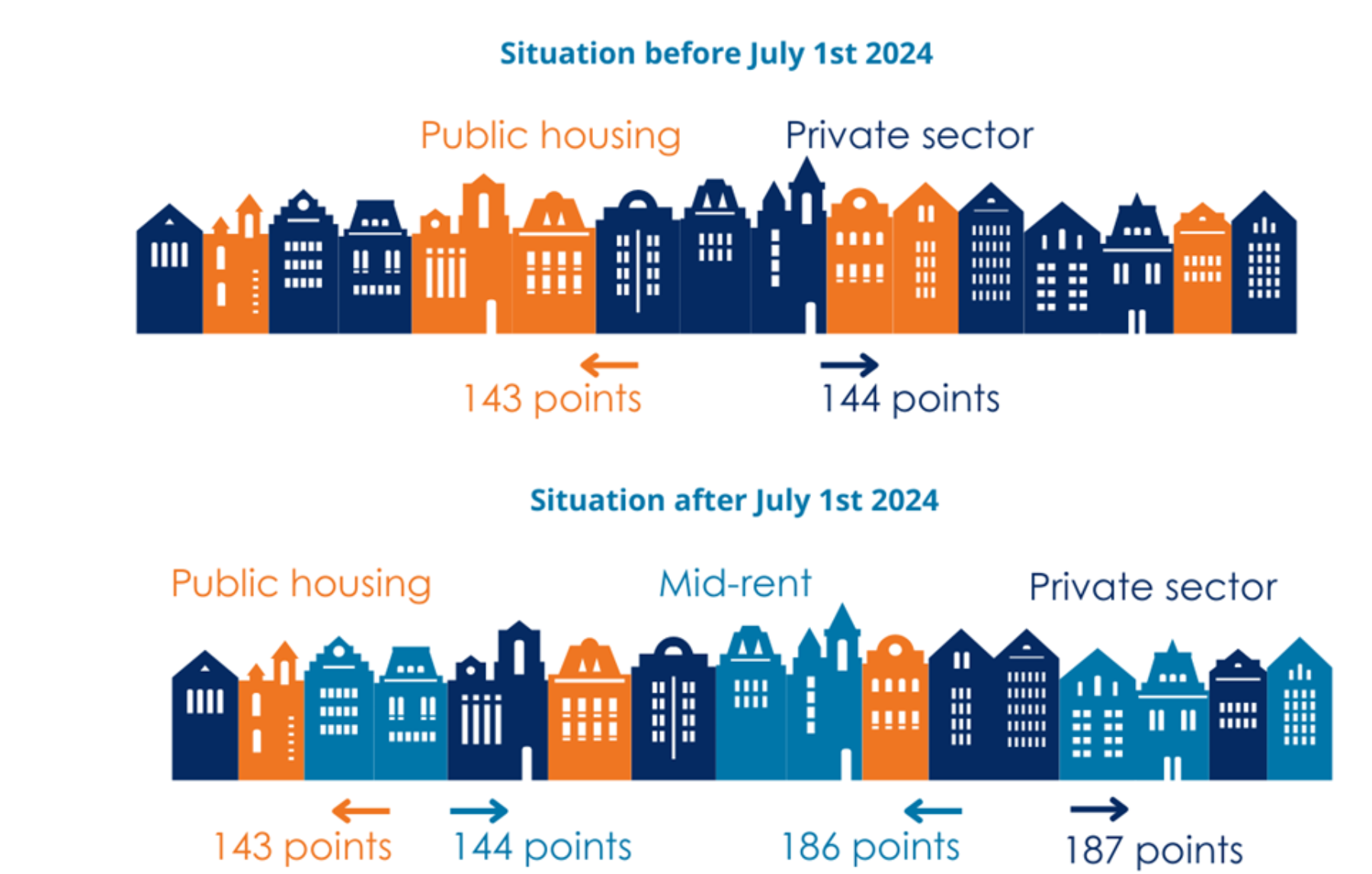

In an effort to alleviate pressure on the rental market, the government introduced the Affordable Rent Act as of 1 July 2024. This legislation brought about a structural change in the determination of rental prices for residential properties, particularly those aimed at middle-income households. Now, almost a year later, we are able to assess the impact of these measures.

The Affordable Rent Act aimed to create a greater supply of affordable rental housing. A home valuation system was introduced, accompanied by a points-based mechanism to determine the quality of rental properties more accurately. The quality of a dwelling is assessed according to predetermined criteria; the higher the quality, the more points the property receives, thereby allowing a higher rent to be charged.

Prior to the introduction of the Affordable Rent Act, there existed a distinction between the social rental sector and the private rental sector. In the social sector, maximum rents were regulated, whereas in the private sector this was not the case. Following the implementation of the Affordable Rent Act, the proportion of dwellings subject to a maximum rent has increased significantly.

As illustrated in the accompanying image above, the introduction of the Affordable Rent Act has resulted in a substantial change: a new regulated mid-rental segment has emerged, for which maximum rents are now capped. In practice, this means that rents for these properties have decreased; previously, they fell within the unregulated private sector, but that is no longer the case. Regulation of these properties ensures that the high rents of the past can no longer be charged. This was indeed the objective the government had in mind with the introduction of the legislation.

However, there has been an (unforeseen) side effect of this legislative change. As owners of mid-segment properties are now able to charge lower rents, many have opted to sell their properties. This has provided some relief to the housing market for buyers (especially benefiting first-time buyers), but has resulted in even greater pressure on the rental market. It can therefore be concluded that the new legislation has overshot its intended goal.

Amendment to the Affordable Rent Act discussed in the 2025 Spring Memorandum

As previously mentioned, the introduction of the Affordable Rent Act has led to an even tighter Dutch rental market. For this reason, the government announced in its 2025 Spring Memorandum that it intends to amend the Act as follows:

- Fewer rental properties will fall under the Affordable Rent Act: by applying a lower points threshold, the group of regulated properties will be reduced, although the government will continue to regulate the lower end of the rental market for low and lower-middle income groups.

- The WOZ value (property valuation by the government) will carry greater weight in determining the rent: this will allow higher and more market-conform rents to be charged for properties in larger cities.

- The government is exploring whether it is possible to exempt small-scale landlords from regulation: for example, owners who let out a second home.

In addition, the government has announced that rents for social housing will be frozen in both 2025 and 2026. We have written a separate article on the Spring Memorandum and what impact it will have on the Dutch housing market.

Property to remain in Box 1 for the time being

In 2021, De Nederlandsche Bank (DNB) published an article on the state of the housing market. They indicated that the problems in the housing market are not solely attributable to a shortage of supply, but also to demand-side factors. It was noted that there has been a housing shortage for several decades, but the current pressure on the housing market has only arisen in recent years. DNB states that house prices strongly correlate with consumers’ disposable income, and that pressure on the housing market could be alleviated if measures are taken to address demand. If the fiscal advantages of home ownership are reduced, disposable income will also decrease, and prices will rise less rapidly.

DNB proposed four measures arising from this line of reasoning. One such measure is to tax the primary residence not in Box 1, but in Box 3. This would mean the abolition of mortgage interest relief (hypotheekrenteaftrek) and the imputed rental value (eigenwoningforfait), with the capital gains on the property then being taxed in Box 3. The proceeds could be used by the government to lower taxes in both Box 1 and Box 3.

Although this proposal was published in 2021, it has recently received renewed attention in the market. DNB’s plans have been widely covered in the media, prompting responses from many stakeholders. As a result, the government felt compelled to issue an official response, stating that the primary residence will remain in Box 1 and that capital gains on the property will not be taxed. While it remains to be seen what future policymakers may decide, for the time being, the primary residence will remain in Box 1.

Foundation risks in the Netherlands: challenges and impacts

Foundation risk has long been a recognized issue in the Netherlands, but in recent years, it has received growing attention across various sectors. The causes are complex and stem from a combination of factors. Climate change is a major contributor, with rising sea levels, heavier rainfall, and prolonged droughts causing fluctuations in groundwater levels. These changes are particularly damaging to wooden pile foundations, which can deteriorate when groundwater remains too low for extended periods. The risks are especially severe in regions with soft soil, like peat and clay areas, where these challenges are most pronounced.

Not only are wooden pile foundations at risk, but shallow foundations are also vulnerable. Shallow foundations, which transfer a structure's load to the ground at a relatively shallow depth (usually just a few meters), can be significantly affected by accelerated subsidence. As the ground shifts, buildings on shallow foundations may lose their bearing capacity, leading to visible damage such as misalignment, cracking, or moisture issues.

Let’s take a closer look at the total housing stock in the Netherlands.

Current state of the Netherlands

The Netherlands has approximately 8.1 million residential properties spread across 6.4 million buildings with some housing multiple units such as apartments. Fundermaps[1]' recent report categorizes foundation types with data confidence levels: confirmed (direct investigation), derived (comparable buildings), and model-based (estimates based on construction year and ground data). Of these buildings, around 370,000 (of which 117k confirmed, 68k derived and 185k model-based) have wooden pile foundations, and 3.65 million (of which 70K confirmed, 178K derived and 3.4 million model-based) have shallow foundations, which are common for smaller buildings due to cost-efficiency and practicality. About 500,000 of these are at increased risk of foundation issues. The estimated cost for foundation repair in the Netherlands will reach up to 55 billion euro by 2050. The cost per home for foundation repair is estimated between 50,000 and 100,000 euros, depending on the extent and nature of the damage. It should be noted that these figures are primarily based on forecasts.

Working towards a solution

Firstly, it’s challenging for individual homeowners to take action, as they are rarely the only ones in their street or neighborhood needing foundation repairs. Coordinating repairs among multiple homeowners is difficult, especially since financial solutions are handled on an individual basis. Currently, homeowners are left to find their own financial solutions for foundation damage. A national fund has been established to offer loans to homeowners who urgently need repairs.

Footnotes

1 FunderMaps provides insight into the types of building foundations and foundation risks of real estate in the Netherlands through data analysis and mapping technology and is developed by the KCAF (Knowledge Centre for Foundation Problem Approach) which is a non-profit foundation in the Netherlands focused on collecting, developing, and disseminating objective and reliable knowledge about foundation problems in buildings.

Want to know more?

This article is the first chapter of our quarterly market update for Q1 2025. In this report, we outline developments in the Dutch economy, the housing market and the mortgage market.