- +23% increase in mortgage applications in Q1 2025; March busiest month since April 2022.

- Strong growth in major cities, driven by rental property sell-offs.

- First-time buyers and remodelers lead the surge, especially in the higher starter segment.

- Sustainability financing drops, while arrears among self-employed rise post-COVID.

March 2025: Busiest month since April 2022

Mortgage applications went up significantly early 2025 resulting in an application increase of over 23% in the first quarter vs the first quarter of 2024. With 53,392 applications, March was the busiest month since April 2022. Applications for home purchases rose by almost 20%. Applications for further advances and refinancing (non-purchase) even increased by over 30%. HDN cited the rising mortgage interest rate trend and the increased number of rental properties being sold in Q1 as the main causes.

In the mortgage market, the effects of the new rental policy are visible. In big cities, a clear increase in the number of mortgage applications for home purchases is seen. In the four largest cities: Amsterdam, Rotterdam, The Hague and Utrecht, HDN saw the number of mortgage applications grow almost twice as fast as the national average. This as a result of more landlords selling their properties as they face stricter legislation this year.

Applications for remodeling and first-time-buyers dominate

Applications for remodeling as well as for first-time-buyers grew in Q1. One in five applications was an application for remodeling. This was followed by the first-time-buyers. HDN distinguishes two sub-categories in the first-time-buyers segment; (1) the Starter High segment; this segment grew strongly by 34% compared to Q1 2024. and (2) the Starter Young segment; this segment saw a more modest plus of almost 16%.

Refinancing picking up?

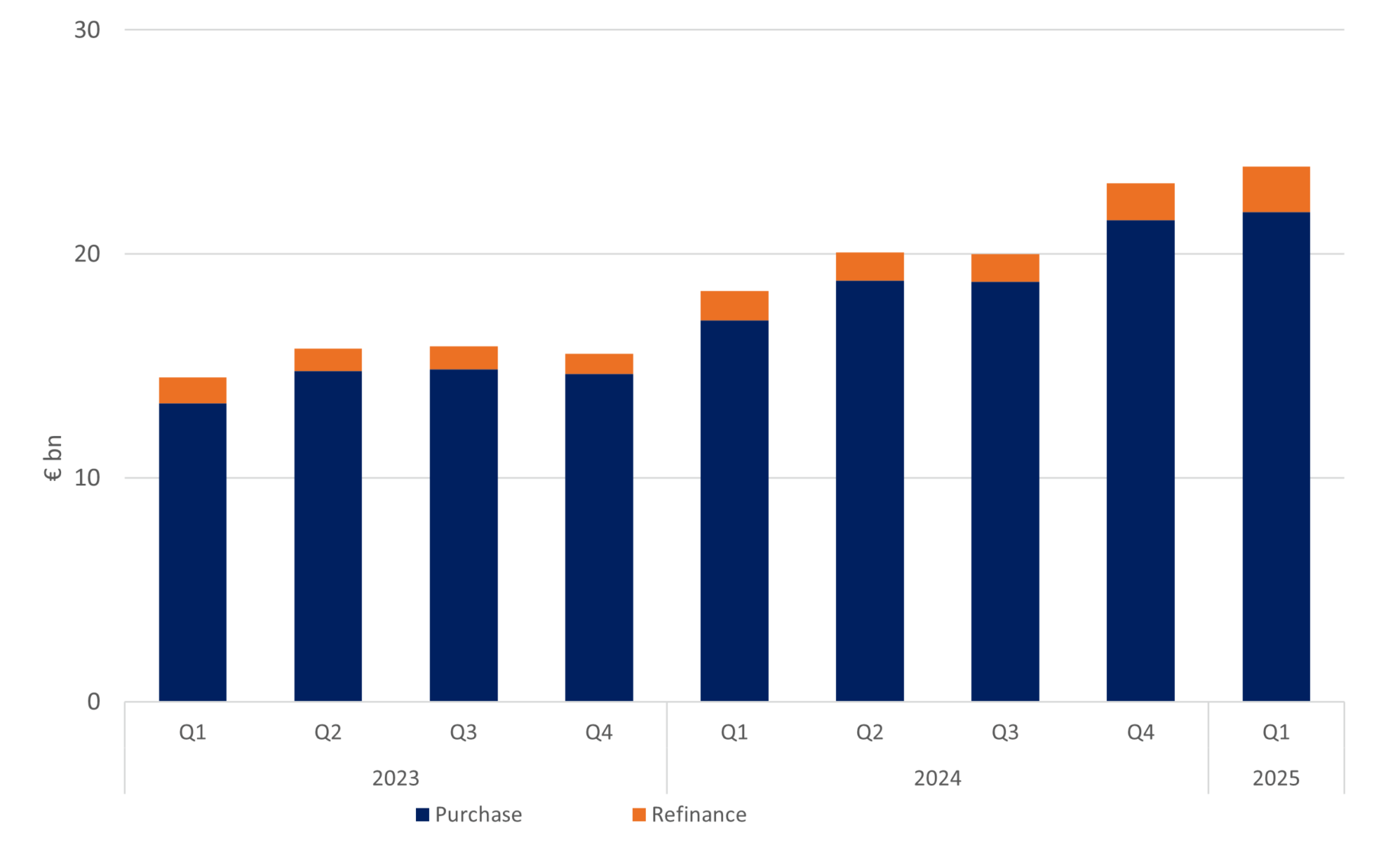

The refinancing market appears to be picking up. There were 11,307 applications for refinancing in the first quarter. This is a 45% growth from Q1 2024. Nevertheless, refinance volumes remain very low. However, the increase indicates that consumers are again showing interest in refinancing, figure 1.

Figure 1: Applications by loan purpuse excl bridge loans

Source: HDN, DMPM analytics

Loan porting applications in decline

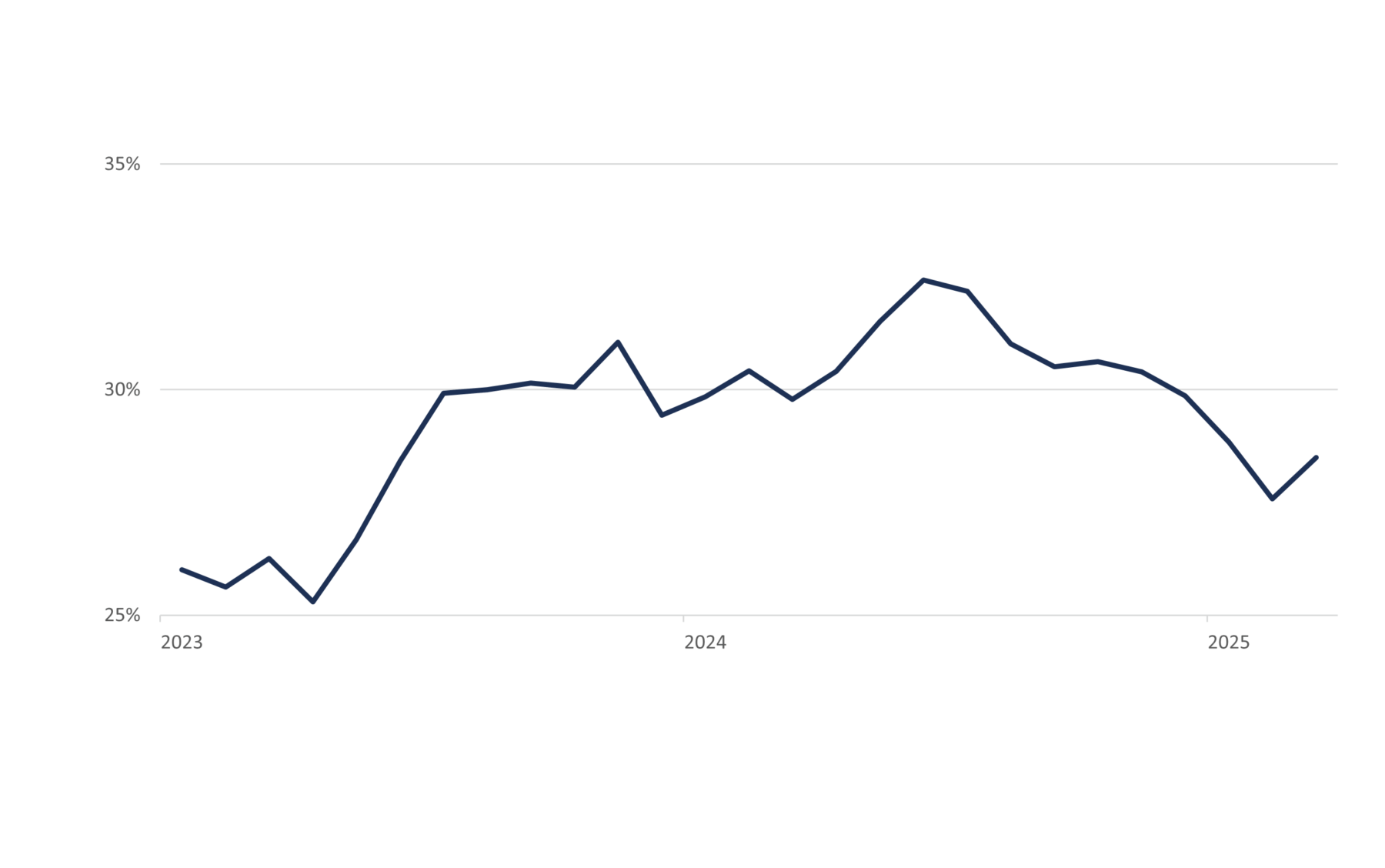

A decline in loan porting applications is still visible in the purchase market. As from mid-2024 a downward going trend can be seen. Since the share peaked in June 2024 at 32%, it started dropping month over month to 28% in February 2025, figure 2. Contrary to the trend of the past seven months, we see a slight increase in the number of ported loans in March this year (29%). This may be due to rising mortgage rates and the exceptionally high number of mortgage applications in March as a result.

Figure 2: Applications by loan porting

Source: HDN, DMPM analytics

Average interest term increases

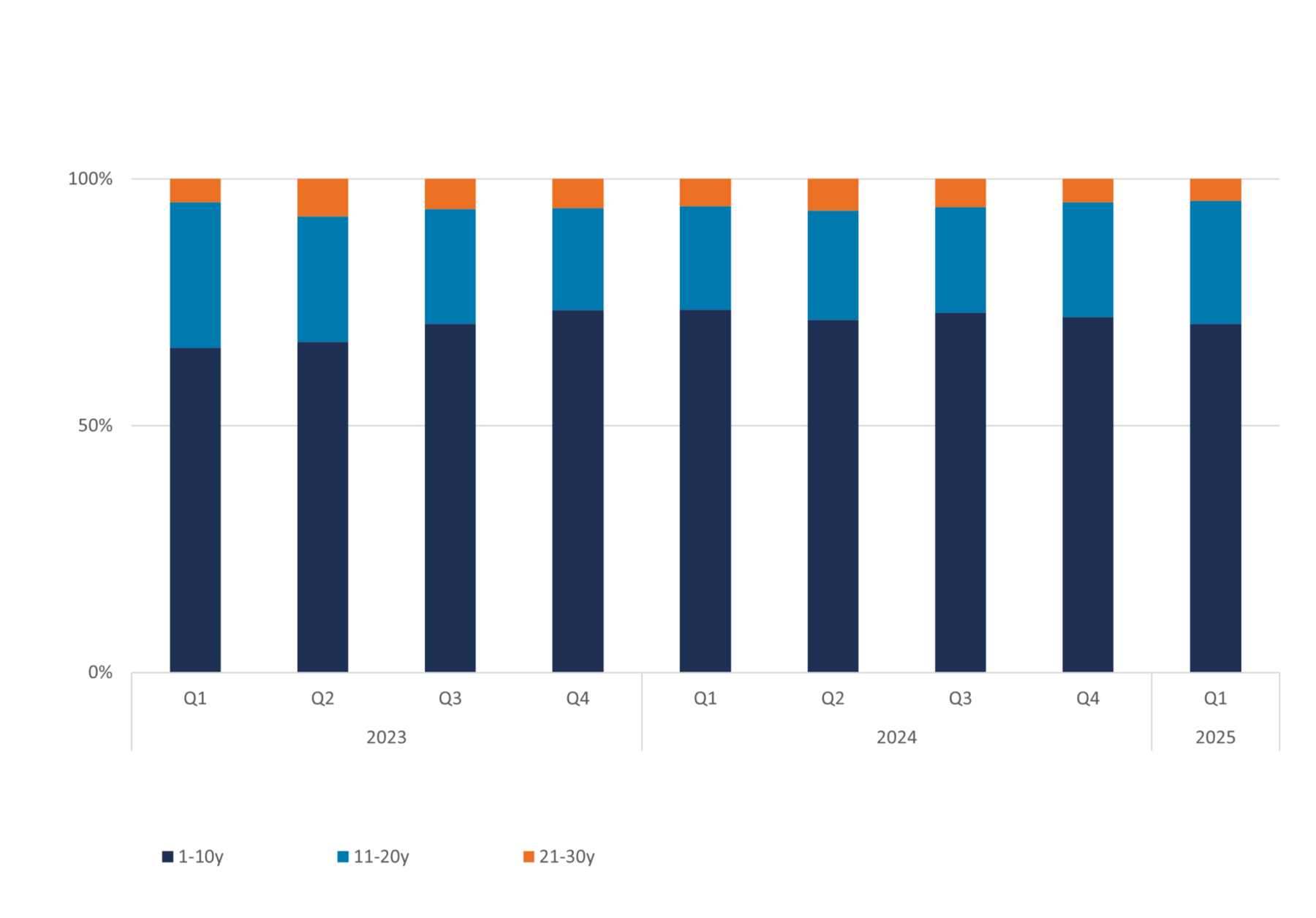

As pointed reflected in our previous Quarterly Update (see our quarterly update Q4-2024 on dmmi.dmpm.nl), the slight decline of the share of 10 years interest fixed at the benefit of 20 years interest fixed is continuing in the first quarter of 2025, see figure 3. Since Q1 2024 we see the 1-10 year fixed decline by 3% point (was 74% is 71%) in favor of the 11- 20 year fixed. The 21 to 30-year fixed showed a decrease of 1% point versus the first quarter of 2024.

Figure 3: Applications by interest rate period excl. bridge loans

Source: HDN, DMPM analytics

Mortgage amounts rise along with home prices

As a result, of the continuing rise in house prices, the average mortgage amount for the purchase of a home also continues to rise. An average of € 370,700 was requested for home purchase mortgages, about 7% more than a year earlier. Within the non-purchase market, more was also borrowed and the average mortgage amount reached € 120,700, compared to € 110,000 in Q1 2024 (+9.8%).

Financing sustainability measures decreases

A sharp decline is visible in co-financing energy-saving measures. In both purchase and non-purchase markets. In Q1 2025, energy-saving measures were co-financed in 13% of applications. This is a 20% decrease from Q1 2024. In recent years, homeowners benefited from favorable conditions: low interest rates, stimulating subsidies and stable policies. Now these variables have changed and labor and material prices are high, the business case is less attractive for many consumers. This results in an increased wait-and-see approach from homeowners to implement sustainability measures. In the non-purchase market retired people had the largest decrease in the use of energy-saving measures. In only 5% of applications, these were co-financed. This is a 35% decrease from the first quarter of 2024.

Development of arrears.

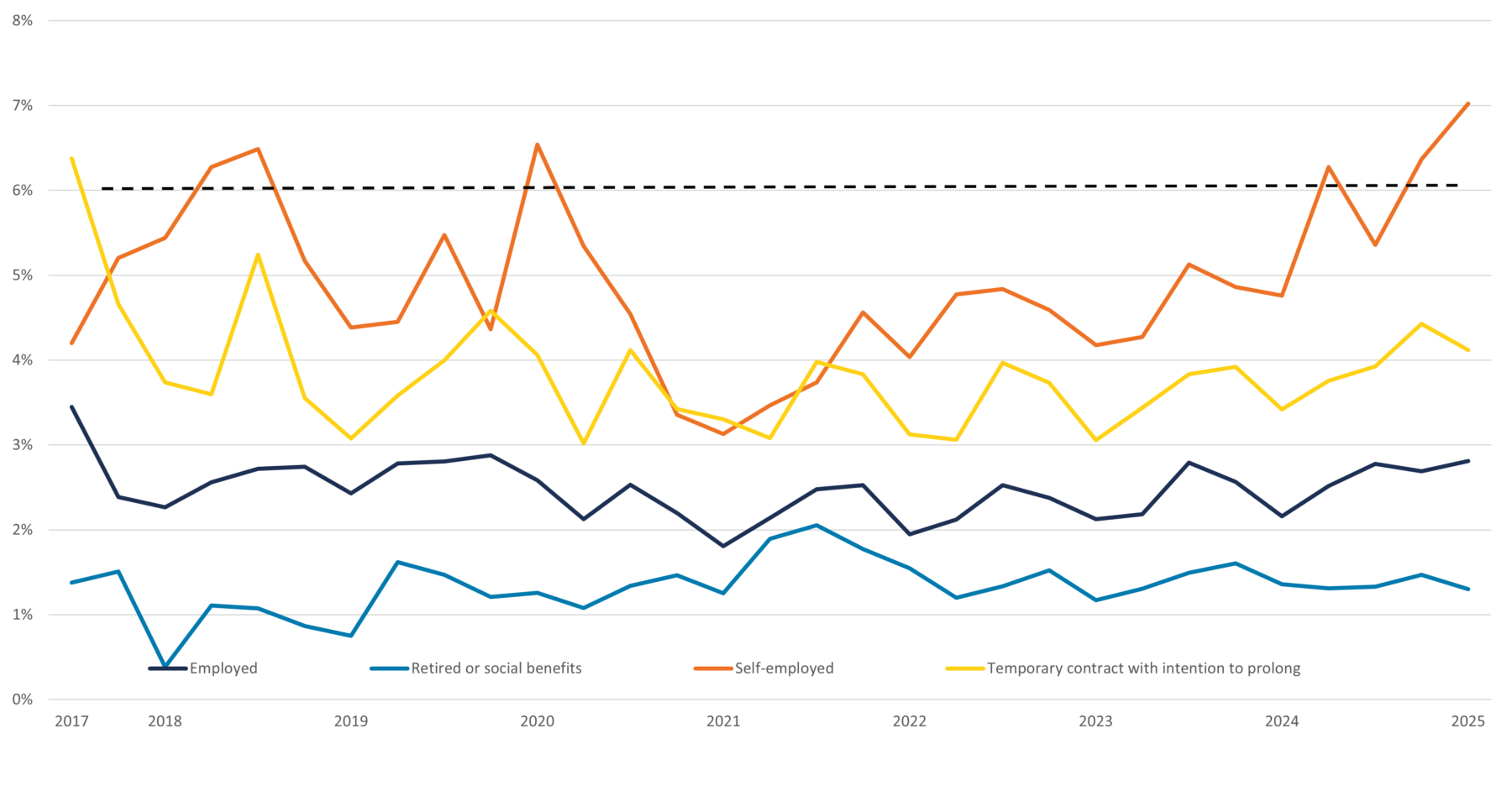

If we look at the evolution of payment delays in the portfolios disaggregated by income type, we see that the payment behavior of self-employed entrepreneurs, after the end of the COVID subsidy schemes, returns to pre-2020 levels, figure 4. In general terms, you can see that the lines diverge from the end of 2022 (end of COVID) where at the time of the COVID subsidies there were converging lines. This seems to be a direct effect of the repayment obligation of the COVID government support schemes. The bankruptcies, delayed by COVID these support schemes, now seem to be taking effect.

Figure 4: Development of arrears inflow

Source: HDN, DMPM analytics

Want to know more?

This article is the first chapter of our quarterly market update for Q1 2025. In this report, we outline developments in the Dutch economy, the housing market and the mortgage market.